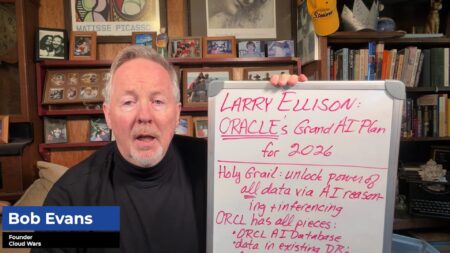

Oracle is merging its legacy databases, apps, and infrastructure into an all-inclusive AI stack to dominate the fast-growing AI economy, according to Larry Ellison’s recent earnings call.

Earnings Call

ServiceNow and Palantir are locked in a high-stakes battle to dominate the AI platform market and define the future of enterprise software.

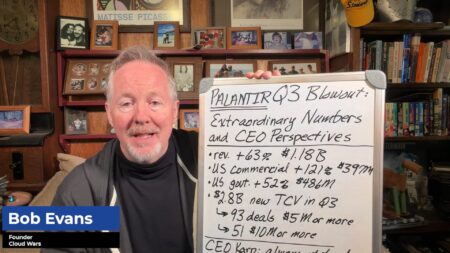

Palantir’s AI momentum is being driven by CEOs eager to scale beyond pilots to full enterprise transformations.

Strategic federal wins and healthcare momentum underscore Workday’s strong Q3, with AI adoption driving customer expansions and renewed 10-year commitments.

Google Cloud’s Q3 2025 saw explosive 34% growth, a $155B backlog, and more billion-dollar AI deals than the last two years combined, cementing its rise as the AI-first cloud powerhouse.

A record-breaking quarter shows Palantir redefining how AI and data can transform entire industries.

Despite Oracle’s AI infrastructure play, SAP stays the course with a strong software-first AI strategy, avoiding multibillion-dollar CapEx.

Oracle’s Q1 results set records, but Ellison is focused on the future, predicting that AI inferencing will automate every major industry process and that Oracle is uniquely positioned to lead.

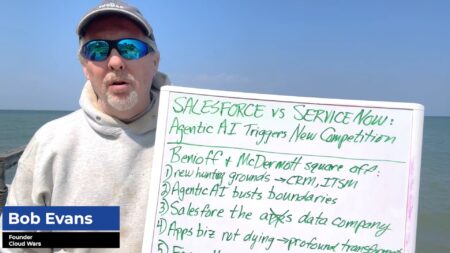

Marc Benioff refutes the “SaaS is dead” narrative with data, biblical wisdom, and a vision of AI-enhanced applications at Salesforce.

Agentic AI is driving ServiceNow and Salesforce to expand beyond their traditional domains of ITSM and CRM.

CEO Sridhar Ramaswamy confirms AI as Snowflake’s growth engine, influencing 50% of new customers and becoming central to 25% of deployments, while Q2 revenue climbs to $1.09B amid rising competition.

Palantir’s Ontology platform powers real-time decision-making for clients like Citibank, Fannie Mae, and Lear, reducing processes from days to seconds.

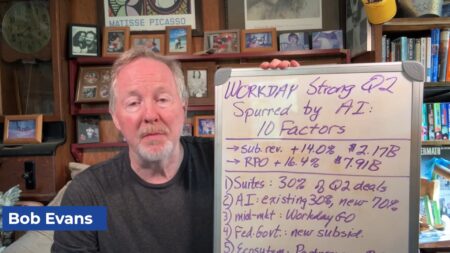

Workday delivered 14% growth in subscription revenue in Q2, powered by widespread AI adoption across new and existing customers.

Workday reported strong Q2 growth driven by widespread adoption of its AI solutions, expansion into mid-market and government sectors, partner contributions, and new global initiatives.

Even with $90 billion in Q2 CapEx spending, the major hyperscalers say cloud and AI demand will exceed supply until at least late 2025.

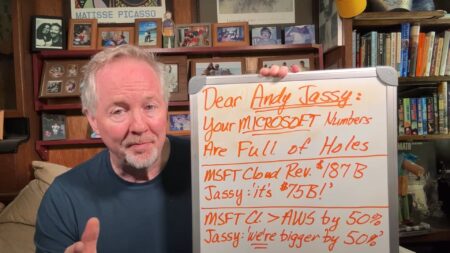

Analysts grilled Jassy on AWS’s relative underperformance — and the numbers don’t lie: rivals are catching up fast.

Despite strong revenue growth, AWS’s positioning in its latest earnings call drew scrutiny, especially when comparing its performance to Microsoft and other hyperscalers, whose cloud businesses are accelerating more rapidly.

Satya Nadella identified three drivers of Azure’s Q4 growth: on-prem migrations, native app scaling, and AI expansion.

Satya Nadella broke tradition in Microsoft’s Q4 call, directly comparing Microsoft’s AI and cloud capabilities to AWS, Google, and Oracle, citing unmatched scale, speed, and infrastructure capacity.

In Q2, IBM showcased how AI is expanding — not replacing — its legacy products, with strong adoption of AI-assisted tools for mainframes.