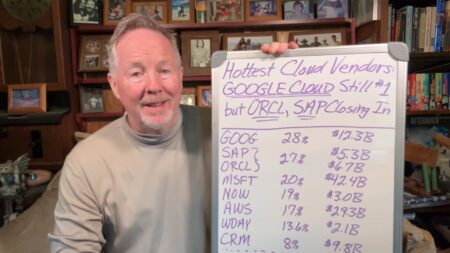

AWS hit 20% growth in Q3, but Microsoft, Google Cloud, and Oracle outpaced it in AI-driven revenue and future backlog.

Cloud Revenue

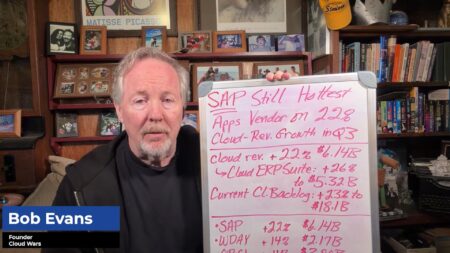

Despite Oracle’s AI infrastructure play, SAP stays the course with a strong software-first AI strategy, avoiding multibillion-dollar CapEx.

SAP’s focus on evolving its cloud ERP and Business Data Cloud platforms is paying off with dramatic Q3 gains.

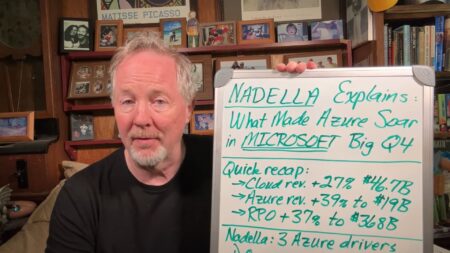

After 12 years as CEO, Satya Nadella is delegating major commercial duties and seems poised to transition toward a chairman/CTO role — an Ellison‑style shift.

Google Cloud led all major providers with 32% Q2 growth, narrowing the revenue gap with AWS despite its smaller base, fueled by skyrocketing AI demand across industries.

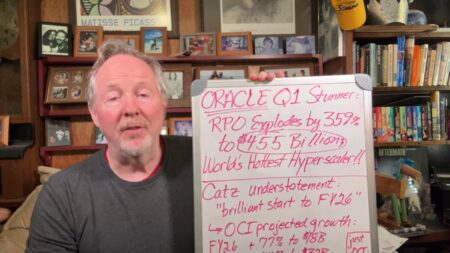

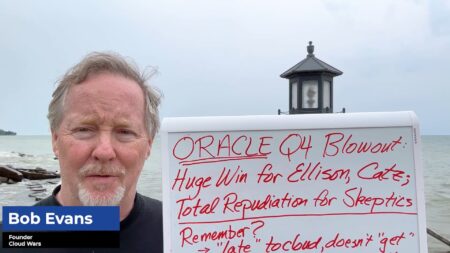

Oracle’s $455B RPO marks an industry-first, setting the stage for massive cloud infrastructure revenue growth through 2030.

Oracle’s RPO has skyrocketed 359% to $455B, surpassing Microsoft and reshaping the cloud computing hierarchy.

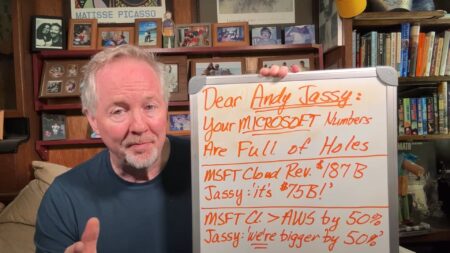

Analysts grilled Jassy on AWS’s relative underperformance — and the numbers don’t lie: rivals are catching up fast.

Despite strong revenue growth, AWS’s positioning in its latest earnings call drew scrutiny, especially when comparing its performance to Microsoft and other hyperscalers, whose cloud businesses are accelerating more rapidly.

Satya Nadella identified three drivers of Azure’s Q4 growth: on-prem migrations, native app scaling, and AI expansion.

In Q4, Microsoft Azure hit $19B, growing 39% YoY. CEO Satya Nadella cited three drivers: on-prem to cloud migrations, AI workload growth, and rapid scaling of cloud-native e-commerce apps.

AWS’s strong Q2 results falter when compared to the accelerated AI-driven growth of Microsoft, Google Cloud, and Oracle.

Google Cloud’s explosive Q2 growth in revenue, backlog, and AI momentum positions it as a serious contender to challenge Microsoft’s long-standing dominance in the Cloud Wars.

SAP’s Q2 cloud revenue rose 24% to $6B, marking a slowdown from past quarters but still outperforming major competitors like Oracle and Salesforce.

SAP posted strong Q2 results with 24% cloud growth, but backlog growth slowed to 22%, down from 28% in Q1, raising questions about market uncertainty, especially in the U.S. public sector.

SAP is projected to post 27% Q2 cloud revenue growth and a 29% rise in backlog, driven by AI adoption and a strong ecosystem strategy, outpacing rivals like Oracle and Microsoft.

Oracle and SAP have rebranded themselves as cloud-first AI powerhouses, rivaling Google Cloud’s dominance.

The latest Cloud Wars update reveals strong growth across major cloud providers, with shifting dynamics that signal an increasingly competitive and evolving market.

Once doubted, Oracle’s cloud strategy pays off big as it reports a 41% RPO surge and forecasts FY26 cloud growth over 40%, led by relentless AI infrastructure demand.

Oracle’s Q4 results stunned the market, with Safra Catz projecting $35B in cloud revenue and 100% RPO growth in FY26.