Making the business case for invoice automation is a top priority for industry leaders. This Bottomline whitepaper identifies 3 steps to your business case

Search Results: open source (2027)

Note: This is a step-by-step guide, so it can equally be used by People with beginner or advanced Power Apps knowledge.

If you are just getting started with Power BI you may be seeing a lot of references to a ‘Calendar’ Table or ‘Date Table. Maybe you already have a handle on this aspect of PBI, but a lot of people seem not to understand how to get started. If you forego having a ‘Calendar’ Table altogether, you can end up having a very cumbersome file and you won’t be able to take advantage of many of the awesome date/time functions offered through Power BI. There are quite a few good resources already out there.

Hi folks!

In the last few days we have observed several news about the Coronavirus that started in China and around the world today is globalized in several regions of the world!

My concern is to understand the seriousness of this moment and nothing better than numbers to reach the conclusion that the situation is critical!

We get the most value from Power Platform when we truly embrace it as a platform. In other words, while the component parts — Power BI, PowerApps, Flow, Common Data Service, and even Dynamics — are incredible tools in their own right, the more we knit them together, the more valuable they become.

But how do larger organizations truly adopt that platform at scale? How do we maturely infuse enterprise management, governance, and best practices into our adoption such that we empower our business users to buil

Many organizations are adopting the Power Platform because PowerApps and Flow make it so quick and easy to build business solutions without any need for the traditional software development life cycle. However, the ease of use of PowerApps is a double-edged sword. While it’s relatively easy to get up and running with PowerApps, you’ll also find plenty of ways to get yourself in trouble and to create the canvas-app-from-hell that’s impossible to maintain and evolve.

Human resources departments are becoming strategic partners within today’s organizations. No longer do they exist only to hire, fire, and pay employees. HR professionals are critical to an organization’s long-term growth and development.

The TCJA made significant changes to how federal tax is calculated for individual taxpayers. In addition, many of the long-time exemptions no longer apply for tax year 2018 and beyond. These changes make it difficult to estimate the correct amount of tax to withhold from employees’ paychecks. Historically, sensitive information, such as income from sources other than that particular job, wouldn’t be shared with employers.

The TCJA Effects on W-4 Withholdings, Deductions

Below we have provided a one-stop shop of quick Coronavirus employer facts and tips that are easy to digest.

This powerful combination of humans and machines can significantly help finance teams to control their DSO and bad debt driving a greater contribution to the improvement of cash flows.

The case discusses the inclusion of women in today’s political sphere. This is resulting from the agitation in women empowerment and gender equality and that for a change to be brought about, women are to be actively involved in governance.

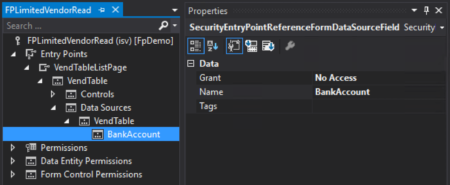

Learn how to set up field level security in D365FO.

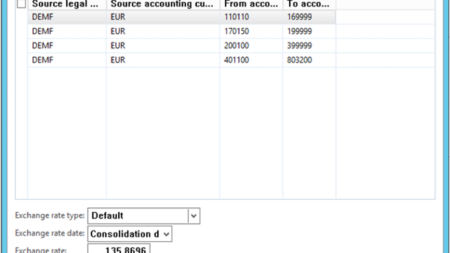

When preparing consolidated financial statements that include a foreign subsidiary, the financial statements of the foreign subsidiary need to be translated to the reporting currency of the parent. Learn how!

Learn about defining the right implementation model for ERP implementation or upgrade.

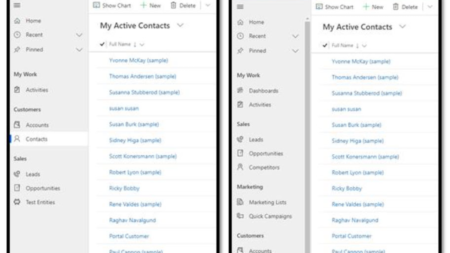

D365 CE Team Member License Enforcement, how will this impact your users?

As the pace of business accelerates, organizations have to drive efforts to keep up with the times. For businesses using…

By Alan Wyne, Aug 27, 2020If you have been in the Microsoft Dynamics community long, then you no doubt have…

By Dan Doolin, Jun 11, 2020Expanded Family and Medical Leave Act (E-FMLA) SimplifiedThe Families First Coronavirus Response Act (FFCRA) consists…

By Marlene Mankin, May 8, 2020When it comes time to make a new budget, are you thrilled? Or perhaps feeling…

By Marlene Mankin, May 22, 2020It can be highly frustrating to encounter RapidStart errors and not know what to do…