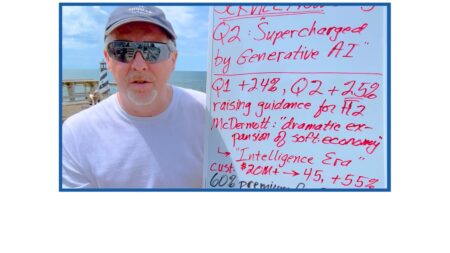

ServiceNow backs up it recent jump from #10 to #6 on the Cloud Wars Top 10 list with a strong financial performance and an optimistic outlook.

Search Results: customer (5234)

Appian program delivers a series of process mining services at a fixed fee, all aimed at delivering rapid time to value and overcoming common hurdles.

Generative AI is playing a central role in the powerful growth and earnings being reported by Cloud Wars Top 10 company ServiceNow.

Celonis Co-CEO Alex Rinke explains how process mining software addresses pressing macroeconomic factors in this highlight from the Acceleration Economy Process Mining Battleground.

AI capabilities, generative AI customer count, and operating profits are just three of the reasons that Google Cloud replaced AWS on the Cloud Wars Top 10 list.

During times of “hyperchange,” having a clear communication framework is crucial for avoiding misunderstandings and anxiety, building trust, and improving decision-making.

In this Cloud Wars Top 10 course segment on IBM, gain insight into the three things CEO Arvind Krishna has done that modernized IBM and contributed to its Cloud Wars Top 10 status.

Google Cloud’s latest quarterly results and strong growth validate its elevation to #2 on the Cloud Wars Top 10, while they also highlight its strength in supporting AI customers.

The factors that drive most cloud vendor rankings may or may not be useful in a partners ecosystem context. The Cloud Wars Top 10 is a better option.

In this Cloud Wars Top 10 course segment on Snowflake, gain insight into the data cloud and app dev innovations that earned Snowflake a spot in the rankings.

SAP’s new partnership with Bain sets out to transform the world of cloud ERP, addressing the challenges of traditional systems. Where do partners fit in?

Celonis’ track record of delivering major savings for customers, innovations including object-centric functionality, and plans to tap generative AI highlight a discussion with co-CEO Alex Rinke.

Trend Micro’s market share is more than twice the size of its closest competitor in the cloud workload security sector, according to IDC report.

Approaching the release of the Q2 financial results of Amazon, AWS’ growth rate decline stands out relative to Cloud Wars Top 10 adversaries.

SAP Signavio General Manager Rouven Morato explains how the company’s process mining capabilities empower customers with fast time to insight and adaptability. His insights are part of the Process Mining Battleground.

Although it’s not as big as other Cloud Wars Top 10 companies, the growth rate of Oracle has been accelerating at a higher rate than that of competitors.

Drawing on its rich legacy in enterprise apps and data, SAP Signavio uses innovative process mining functionality to optimize ERP migrations and optimize customer-facing functions.

Databricks recently acquired MosaicML for $1.3 billion, and the combined firms are poised to develop robust machine learning and generative AI capabilities for enterprises.

SAP Signavio’s end-to-end transformation suite, bolstered by data and process insights, optimizes processes from application migrations to customer service, GM Rouven Morato says.

Celonis’ process mining software is expanding its reach across many businesses, with use cases applicable to supply chains, procurement, and more.