IBM today said it has signed a cloud deal with BNP Paribas that one analyst believes could be valued at $2 billion, setting up a big 2019 for IBM.

Search Results: cloud infrastructure (1497)

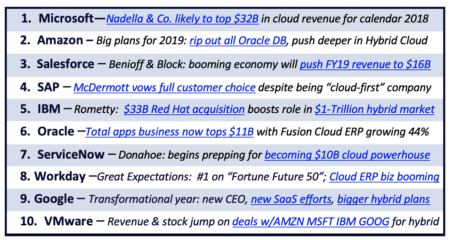

IBM’s new hybrid cloud megadeals show why the vendor has retained the #5 spot in the Cloud Wars Top 10 here at the outset of 2019.

What a recent blog post reveals about how AWS is gunning for victory in the Amazon versus Oracle cloud database competition.

A look at how 3 cloud heavyweights—Oracle, SAP and Google Cloud—are positioning themselves for the coming hybrid-cloud revolution.

Larry Ellison using Oracle Autonomous Database to redefine the cloud industry to play to Oracle’s dominant strengths instead of its Amazon-era weaknesses.

Discover the 5 most-listened-to episodes from the Cloud Wars Live series, the Cloud Wars podcasts arm launched in 2018 to explore digital transformation.

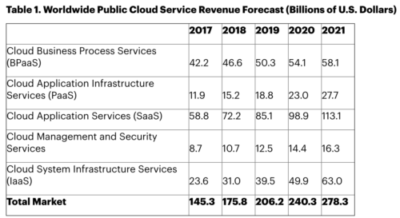

The cloud is becoming the engine of the global digital economy. Read Cloud Wars Outlook 2019 to understand enterprise cloud trends for 2019.

Oracle founder Larry Ellison this week said businesses using arch-rival Amazon’s Amazon Web Services cloud have become major cybersecurity threats

Microsoft has an excellent chance to approach $7.5 billion in Q3 cloud revenue while Amazon is likely to flirt with $6.9 billion.

IBM plans to leapfrog its tech competitors by offering new tools that simplify & streamline the management of complex technologies regardless of cloud or AI

Oracle – Founder, Larry Ellison, said company’s future is determined by fortunes of its Cloud ERP SaaS service & its self-driving Autonomous Cloud Database.

Microsoft’s sweeping transformations of its sales and engineering organizations and its unique focus on intelligent cloud plus intelligent edge.

#1 Microsoft Widens Lead as commercial-cloud revenue surged 53% to $6.9 billion and gave it an $800-million spread for the quarter over Amazon.

Amazon – AWS cloud-computing unit will post exceptionally strong numbers, and those numbers will fail to match those of Microsoft’s in The Cloud.

Microsoft decides to become a global community powerhouse via the acquisitions of LinkedIn two years ago and GitHub last week.

Just a handful of the world’s leading cloud vendors are on pace to generate $100 billion in combined enterprise-cloud revenue this calendar year.

Satya Nadella’s cloud business, Microsoft, is growing at a stunning 58%–and the enterprise cloud hasn’t even begun to reach the fat part of the market.

I wonder if Amazon cloud chief Andy Jassy knows—& takes any comfort from—the history of Bum Phillips? It’s Amazon’s last chance to catch #1 Microsoft in Q1?

Oracle founder Larry Ellison said Oracle will beat Amazon in the cloud by releasing a sweeping set of “self-driving”, cloud solutions.

ServiceNow has pushed its way into a tiny group of cloud-software vendors that customers feel are truly strategic partners, says ServiceNow’s CEO Donahoe.