Microsoft’s 24% increase in cloud revenue for the fiscal quarter was boosted by its partnership with Oracle. The partners are enabling multicloud access to the Oracle database via Microsoft Azure.

Search Results: cloud data (4697)

The discussion unveils a spectrum of AI-driven opportunities, touching upon ethics, a generative AI workforce, climate initiatives, healthcare innovation, and creative expression.

With new LLM Mesh, Dataiku and several launch partners aim to make it easier to adopt generative AI while centralizing administration and enabling permission controls.

SAP is partnering with AWS to enhance its HANA Cloud database, signaling SAP’s increased focus on the cloud-native database market.

Learn the three main ideas behind zero trust packet routing, which involve bringing identity to the cloud, automating policy creation, and emphasizing ongoing policy adaptability.

The challenges posed by the growing use of generative AI, including cost increases and sustainability concerns for data centers.

A conversation about Ampere’s partnership with Oracle to provide sustainable and scalable cloud offerings.

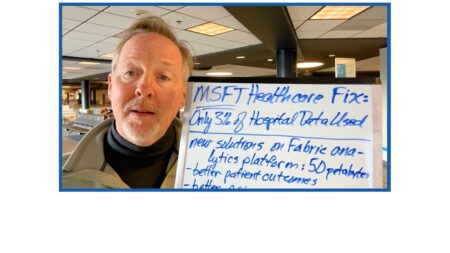

Microsoft aims to address data silos in the healthcare industry to improve patient outcomes and unlock the potential of AI-driven offerings.

Google Cloud is launching industry-specific Generative AI offerings for manufacturing and healthcare, capitalizing on the technology’s potential to transform these sectors.

During the Oracle CloudWorld keynote, Oracle described its expanded partnership with Microsoft and what customers can expect.

Oracle EVP Mahesh Thiagarajan gives insight on the company’s goals with cloud network security and its zero-trust platform.

C3 AI combines its AI models with ESG Book’s datasets to help customers set and meet ESG goals.

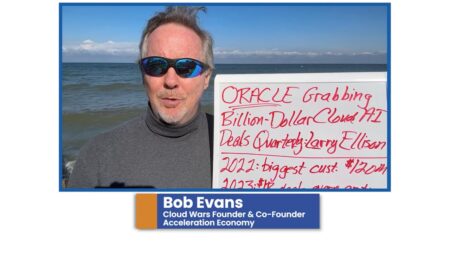

Oracle chairman Larry Ellison reveals Oracle’s confidence in achieving its $65 billion target by 2026, driven by billion-dollar deals in cloud-based AI training and a shift towards country-level engagements, marking a remarkable growth phase in the company’s history.

The Qlik Staige framework is a comprehensive approach to generative AI development, focused on structured data modernization, analytics insights, and rapid deployment.

Oracle’s Larry Ellison announces plans to create a true multi-cloud future, interconnecting with major cloud providers like Salesforce to meet customer demand for seamless cloud integration and freedom of choice.

BMW Group’s advanced driver assistance system (ADAS) will equip a new line of vehicles; AWS will play a critical role in providing the required infrastructure.

SAP CTO Juergen Mueller discusses the GenAI revolution and the future of cloud innovation.

Generative AI was the leading takeaway from Oracle CloudWorld, as Larry Ellison emphasized how the technology would change everything.

Google Cloud allies with AI chip giant NVIDIA to deliver new compute instances that make it faster and easier to develop and deploy AI apps.

Key insights from Oracle’s CloudWorld keynote reveal a shift towards outcome-driven app development and AI-powered innovation, led by Juan Loaiza, EVP at Oracle.