The Cloud Wars Top 10 companies are projected to generate $359.4 billion in cloud revenue in 2023, despite economic challenges, with Microsoft leading at a growth rate of 21.6%, while Oracle is the fastest-growing member with a 38.8% growth rate.

Search Results: cloud (7421)

Informatica’s latest performance results show strong subscription revenue growth as well as a sharp increase in transactions processed.

Projected growth rates for the Cloud Wars Top 10 companies in 2023 showcase the sector’s resilience and rapid expansion.

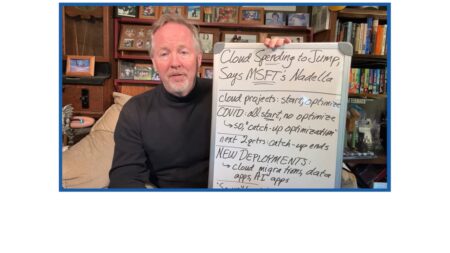

Business leaders are shifting from cost-cutting cloud optimization to investing in cloud migrations, data applications, and AI deployments. Microsoft is poised to capitalize.

Its end-to-end view of the cloud combined with its early embrace of generative AI and massive scale, keep Microsoft in the top spot on the Cloud Wars Top 10.

Cloud investments are poised for a rebound as Microsoft’s recent Q4 results, and commentary from company leaders, indicate.

Despite its smaller size, Google Cloud leapfrogged AWS in the Cloud Wars Top 10. Innovation, CEO vision, and generative AI tools are some of the reasons for its rise.

In an interview with Oracle VP Jenny Tsai-Smith, discussions revolve around the upcoming Oracle Cloud World event, highlighting topics such as AI integration, Exadata advancements, and a focus on developers’ needs.

An update on the Cloud Confidence Index, with Amazon, Google, and SAP leading the index higher.

AWS fell to #3 on the Cloud Wars Top 10, as supply chain innovations and corporate strength are not enough to facilitate growth to combat cloud competitors.

The Cloud Confidence Index uses market caps of top 10 cloud companies as a proxy for business leaders’ confidence in their growth, reflecting customer demand and technology trends. The index is up slightly.

Oracle’s explosive growth, dispersed data centers, industry partnerships, and dynamic CEO have made it the hottest cloud vendor today.

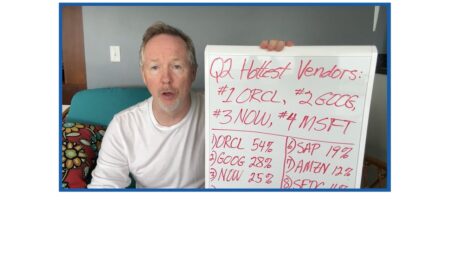

Oracle maintains its position as the world’s hottest major cloud vendor with 54% growth in Q2, followed by Google Cloud at 28% and ServiceNow at 25%.

SAP CEO Christian Klein’s vision and execution powered a cloud transformation that lands it at #5 on the Cloud Wars Top 10.

The four fastest growing cloud vendors’ financial results indicate an upturn in customer spending and preparation for the generative AI revolution.

ServiceNow’s investments in generative AI, willingness to work with competitors’ products, and dynamic CEO are some of the reasons the company leaped from #10 to #6 in the Cloud Wars Top 10 rankings.

Workday strives to make ERP implementations simpler for customers and has strong endorsements to show for its customer-centric approach. The company ranks #7 on the Cloud Wars Top 10.

When migrating financial software to cloud infrastructure, make sure you’re getting the cost savings, operating efficiencies, and transparency you expect.

The Wiz cloud security platform gives comprehensive control over customers’ cloud infrastructure and applications, while providing a visual ‘Graph’ of the environment.

Salesforce’s evolving strategy prioritizes customer-centric innovation, AI integration, and higher profits. It ranks number 8 on the Cloud Wars Top 10.