With Workday Rising opening today, let’s preview 3 key questions Workday faces as it embarks on a journey toward becoming a $10-billion global powerhouse.

Search Results: aneel bhusri (149)

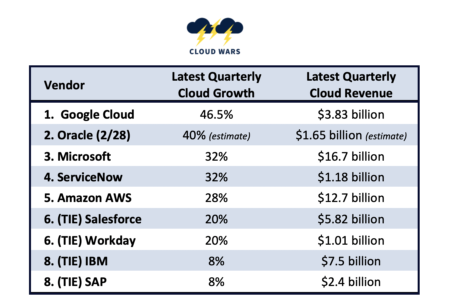

The cloud revenue for #1 Microsoft will exceed the combined total of four high-growth competitors’ cloud revenue for the quarter ended 9/30.

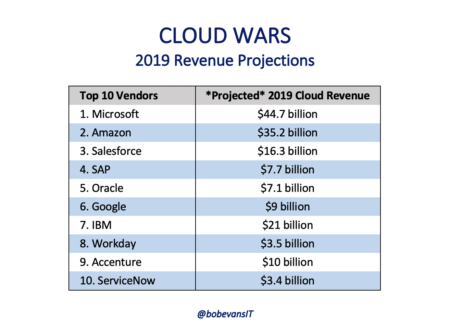

Q3 cloud revenue: for the 3 months ended Sept. 30, I expect that the Cloud Wars Top 10 vendors should combine for more than $40 billion.

At Oracle OpenWorld 2019, Larry Ellison introduced Autonomous Linux and offered his perspectives on the unique value it offers to business customers.

By my projections, the world’s top 10 enterprise-cloud vendors are poised to generate $158 billion in cloud revenue in calendar 2019.

The vibrancy of the dynamic SaaS segment is on full display in new customer-centric initiatives from Cloud Wars leaders Salesforce and Workday.

Market leader Microsoft and #2 Amazon generated HALF of the $37 billion in Q2 cloud revenue rung up by the Cloud Wars Top 10 vendors.

As the enterprise cloud becomes without question the foundation for digital business, we’ve graded the Top 10 vendors. This is the Cloud Wars report card.

There’s little chance that Salesforce is getting into HCM, but after a week of stunning announcements in Cloud Wars, it’s probably best to never say never.

Within the coming year, Workday will likely report its first $1 billion quarter. Read my key takeaways from the company’s recent Q1 earnings call.

It’s interesting to speculate about how three of the world’s top enterprise SaaS companies will respond to SAP and what I’m calling The Qualtrics Effect.

My take: if Workday can back up its big claims about fast, low-cost deployments for customers, Oracle and SAP will have no choice but to catch up.

The big story: Workday Financials has become self-sustaining, putting Workday squarely up against cloud ERP competitors Oracle and SAP.

The Cloud Wars CEO priorities offer an intriguing picture of where those companies’ customers—the world’s leading businesses—are headed.

Cloud heavyweights Oracle, SAP and Workday continue to compete savagely in terms of mission-critical cloud ERP growth going into 2019.

Workday has begun positioning itself as a full-fledged ERP provider whose modern technology and customer-centric approach will begin winning new customers.

As competition among top cloud vendors intensifies, cloud customer success is rapidly emerging as strategic differentiator more important than snazzy tech.

With the recent revenue growth of Snowflake, Workday, and Salesforce, Bob recommends that everyone should embrace a fearless perspective.

The company joins Workday and Snowflake in rejecting the notion of a recession, explains Bob.

Assessing the world’s 9 most-influential cloud vendors’ growth rates, with Google Cloud’s 46.6% leading #2 Oracle and the rest.