AI Index episode 7: CoreWeave builds GPU cloud compute; KPMG invests $2 billion in expanded partnership with Microsoft; and Jeli.io integrates generative AI in its incident management platform.

Search Results: CEO (2718)

Microsoft’s cloud business is projected to generate as much revenue in 2023 as both AWS and Google Cloud combined, highlighting its dominance in addressing customer needs and pioneering in technology.

Bad data can negatively impact digital businesses in a wide range of tangible ways; learn five concrete steps required to purge bad data and maximize data quality.

Intel’s visionary approach to AI spans devices and power levels, promoting an open ecosystem, offering opportunities for diverse product differentiation and innovation.

The Cloud Wars Top 10 companies are projected to generate $359.4 billion in cloud revenue in 2023, despite economic challenges, with Microsoft leading at a growth rate of 21.6%, while Oracle is the fastest-growing member with a 38.8% growth rate.

AptEdge is using generative AI to turn the challenge of data and knowledge sprawl into an advantage when it comes to serving customers.

AI Index Report episode 6: Zscaler develops new tools for IT and security teams; Protect AI secures funding for AI security tools; and Inworld builds a platform to create AI non-player characters, or NPCs.

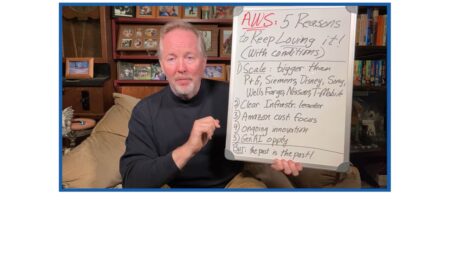

Its growth rate has declined over 18 months, but AWS remains a dominant cloud infrastructure force and customers benefit from its scale, focus on innovation, and generative AI strategy.

Despite declining growth rates, AWS has plenty going for it including its massive scale, cloud infrastructure leadership, customer focus, and potential in the generative AI market.

Organizations that can meet their customers’ need throughout all stages of the relationship are more likely to achieve important financial objectives — from lowering customer acquisition costs to increasing average value contract sizes to boosting profitability.

Its end-to-end view of the cloud combined with its early embrace of generative AI and massive scale, keep Microsoft in the top spot on the Cloud Wars Top 10.

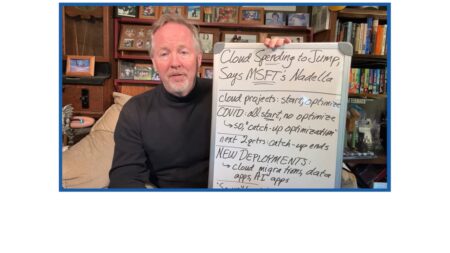

Cloud investments are poised for a rebound as Microsoft’s recent Q4 results, and commentary from company leaders, indicate.

Despite its smaller size, Google Cloud leapfrogged AWS in the Cloud Wars Top 10. Innovation, CEO vision, and generative AI tools are some of the reasons for its rise.

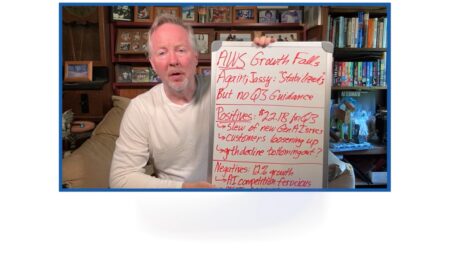

AWS fell to #3 on the Cloud Wars Top 10, as supply chain innovations and corporate strength are not enough to facilitate growth to combat cloud competitors.

Oracle’s explosive growth, dispersed data centers, industry partnerships, and dynamic CEO have made it the hottest cloud vendor today.

AI Index Report episode 5: Qualcomm builds full-stack on-device AI models; SAP invests in Aleph Alpha, Anthropic, and Cohere; and Spotify announces generative AI use cases.

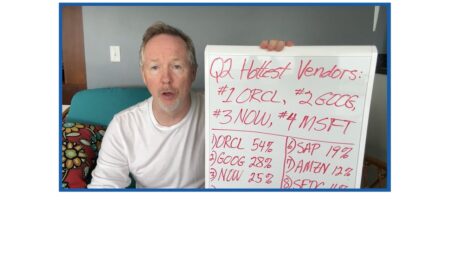

Oracle maintains its position as the world’s hottest major cloud vendor with 54% growth in Q2, followed by Google Cloud at 28% and ServiceNow at 25%.

The four fastest growing cloud vendors’ financial results indicate an upturn in customer spending and preparation for the generative AI revolution.

ServiceNow’s investments in generative AI, willingness to work with competitors’ products, and dynamic CEO are some of the reasons the company leaped from #10 to #6 in the Cloud Wars Top 10 rankings.

Amazon Web Services (AWS) experienced a decline in its growth rate for the seventh straight quarter amid fierce competition from Microsoft, Google Cloud, and Oracle.