If you’ve been reading about blockchain and the Metaverse, you probably heard the classic explanation of the Web1 to Web3 transition. Yet, the umbrella term Web3 is still extremely inclusive, and it can be easy to lose track of the real changes happening that it was originally meant to describe.

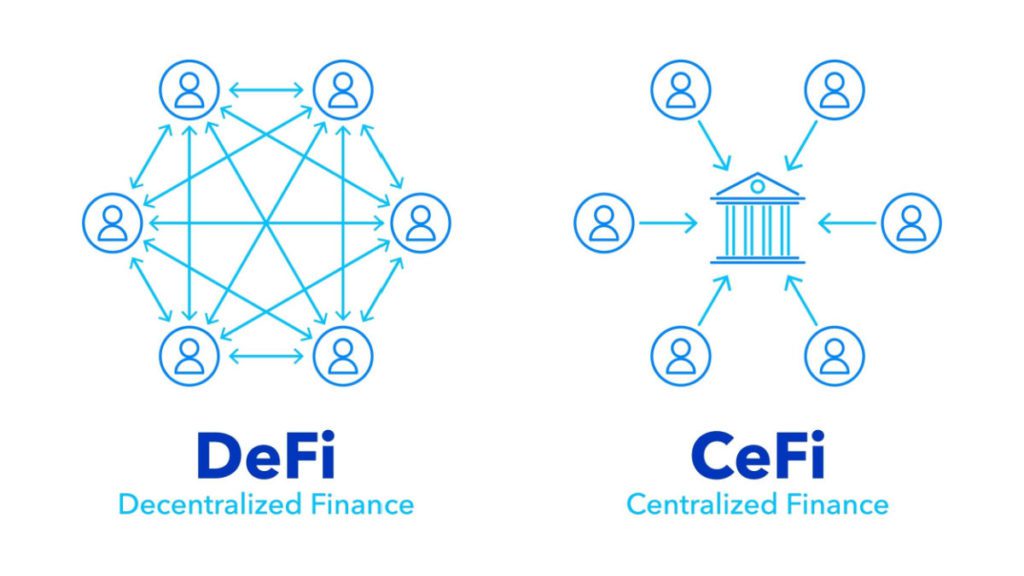

One such change is in so-called DeFi, or decentralized finance, a facet of Web3 that leverages blockchain to provide an open, peer-to-peer financial model as an alternative to the existing models of CeFi, or centralized finance. The DeFi space is rapidly expanding, with new decentralized solutions to traditional banking tasks such as lending, exchanging currencies, and insuring. There are even decentralized solutions for the governance of the DeFi protocols themselves.

However, this article examines DeFi’s foundation, which is decentralized exchanges (DEXs) such as Uniswap, SushiSwap, or Curve. These differ from centralized exchanges (CEXs) such as Coinbase or Binance in several ways, and each comes with advantages and disadvantages.

Centralized vs. Decentralized Exchanges

While centralized exchanges are owned by private entities, have an office, and follow strict regulations of the country they’re in, decentralized exchanges are not owned by a single entity. Instead, DEXs run on open protocols and are usually supported by a distributed team of developers and community forums. DEX-powered financial services, typically provided by a bank or company, are performed entirely by on-chain, smart contract code. Usually, each DEX works on a single blockchain; Uniswap, the largest DEX by trading volume, is only for Ethereum-based tokens.

By contrast, with centralized exchanges, you don’t own your crypto assets directly. Platforms like Coinbase couple your Coinbase login information with assets you purchase, but you don’t hold custody over your own blockchain address on which those assets are stored, since you’re never given a blockchain address.

While hardcore blockchainers often tout “not your keys, not your coins” as a DEX selling point, they neglect to consider that interacting directly with the blockchain can be more difficult for beginners.

Another difference: CEXs have fiat currency on-ramps, while DEXs do not. Ultimately, CEXs have a more user-friendly UX (user experience).

Transaction Fees

CEXs also offload processes from the blockchain, which limits network congestion and reduces gas (transaction) fees. Transfers of tokens between Coinbase accounts, for example, can be executed within the company’s database rather than directly through the blockchain. As a result, transaction fees are very competitive in CEXs, ranging from 0.05% on Pionex to 1.49% on Coinbase.

On decentralized exchanges, you have to cover gas fees yourself, since there is no third-party oversight. That said, it’s worth noting that the discussion regarding gas fees is likely to shift as Ethereum moves to proof-of-stake or DeFi protocols built on top of more scalable chains like Solana proliferate.

Regulation

The types of exchanges also differ in their regulation. CEXs like Coinbase are required by law to protect investors from fraud, hacks, and disingenuous crypto projects. One way they do this is through vetting the coins listed on their platform (Coinbase only supports around 50 coins) or offering insurance against hacks. They also typically require valid proof of identity to comply with know-your-customer (KYC) laws, which does go against the original cypherpunk vision of anonymity.

DEXs and Fraud

DEXs cannot protect investors from fraud in the same way. Uniswap offers exchange services for thousands of coins, many of which are extremely risky or impersonate other blue chip currencies. If an asset swapped on a DEX, or the DEX itself, is hacked, there is nobody to hold accountable other than the investor themself.

On the bright side, however, DeFi’s high risk also usually comes with higher potential returns. DEXs also often have strong community forums for users to communicate their concerns and advice. Plus, without KYC requirements, DEXs do not need IDs or documents, so participation is open to anyone with a wallet, computer, and internet access. This openness is one reason why DeFi is growing at unprecedented speed, jumping from $700 million in locked-up value in late 2019 to over $200 billion in early 2022.

Final Thoughts

As is often the case, both centralized and decentralized models have advantages and disadvantages. While CEXs might be ideal for casual users looking to acquire some blue-chip tokens with fiat currency, DEXs are suited for more experienced users looking for a wider variety of tokens to buy at an earlier time, transacting directly on the blockchain instead of through an intermediary.

Web3 will always contain centralized components, and that’s okay. Despite the alluring high returns and cypherpunk integrity of DeFi trading, CEXs enable newcomers to join the blockchain economy in a safe way. With more and more hacks happening every year, having some central accountability may not be a bad thing.