The following is an excerpt by Acceleration Economy Analyst, Ronak Mathur which appeared in the Future Office of the CFO edition of the Acceleration Economy Journal. The September 2021 issue addressed the role executives play in technology investments, how automation architecture impacts business processes, developing partnerships for optimal business continuity, cybersecurity and risk mitigations, the importance of deep analytical skills, and much more.

As technology progresses at a frenetic pace, global financial departments are under severe pressure to improve efficiency, decrease costs and boost output. In fact, the finance departments lead by CFO’s currently need to substantially transition from traditional, ancient business structures in a large, often global, structure. The automation sector is a major aspect of this transformation, with robotic process automation (RPA) playing a central role in strategy and execution to achieve these needs.

Combining robotic automation with artificial intelligence, RPA automates applications and systems to conduct repeated, human-executed operations. It is also frequently referred to as intelligent automation and hence refers to any software system that may be programmed to accomplish activities that previously needed human intelligence.

Benefits of Intelligent Automation in Finance Departments

With several repetitive and often mundane tasks currently being performed by this automation platform, RPA has profound implications for the finance department of any organization, with the potential to bring significant gains in customer experience, cost reduction, and an increase in the allocation of scarce human resources to more strategic initiatives for the business.

A key benefit of intelligent automation is the ability to reduce, and possibly even eliminate, human errors through the scalability of robots capable of executing operations at speeds not equaled by humans. In many organizations, this scalability means that automated solutions are delivered in record times with significantly bigger volumes and workloads.

Finance departments conduct a range of activities ranging from simple data collection to sophisticated accounts receivable “judgments” for the most valuable customers. As a result, the possibility to improve performance via automation differs between finance functions to make full use of this opportunity.

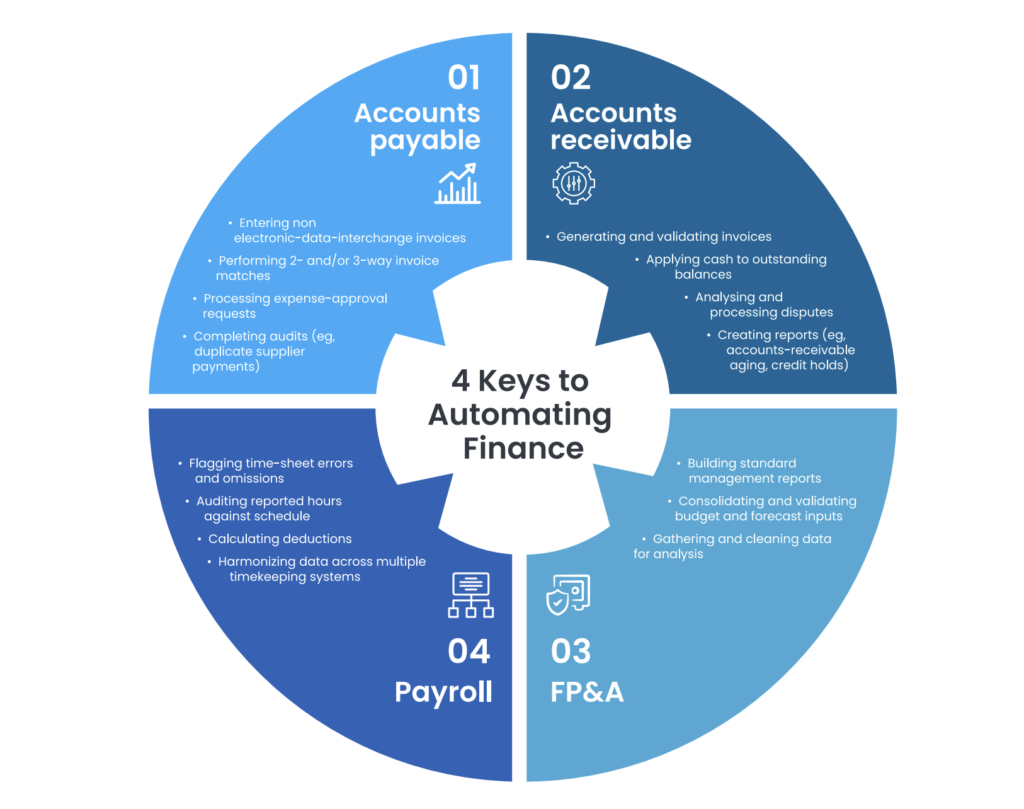

4 Keys to Automating Finance

The pursuit of greater efficiency is part of an ongoing financial transformation for the Department of Finance, where CFOs and financial managers assess innovative approaches for their organizations, to provide enterprises intelligence, data analysis, and more efficient forecasts. The transformation of finances is a path in which the finance function becomes a valued partner via improvement of service delivery, cost efficiency, and compliance. CFOs and finance managers are increasingly leading the way in exploring robotics process automation options. CFOs need primarily to establish a financial team with the correct blend of expertise to execute this transition to achieve and lead this transformation successfully. A laser focus on primary processes (AP, AR, GL) and financial reporting is critical.

The heart of any accounting department deals with accounts that are due and payable. This can contribute to a culture of collaboration between finance and the core functions of cloud business solutions (secure accessibility to all people everywhere).

To achieve your digital transformation journey, you need some early wins with a big impact at the start of your digital journey. AP and AR automation are excellent places to start. Many such activities in the finance department can be automated with relative ease, delivering value and ROI swiftly:

These processes lead to many benefits, including:

- Better Compliance

- Error Removal

- Faster Account Reconciliation

- Scalability

- Cost Savings

- Enhanced Customer Experience

- Smooth Financial Closing and Reporting

Almost any organization that has implemented, or begun an automation project, can attest that the excitement around bots and the impact the bots have on the organization grows as the first bots are deployed. These organizations quickly realize that they must devise a strategy for wisely growing and scaling the bots to meet the growing demand for process automation.

By centralizing the management of bots, cost savings can be realized (e.g., filling bots to capacity before buying additional bots). In a shared services environment, cost models can also be built and managed to allow enterprises to “buy” process robotics development and management services. Finance departments have the competence and knowledge to manage these types of activities and deliver value throughout the firm.

Final Thoughts

In the financial department, automation is already transforming the future of work, and the opportunity to improve performance will accelerate the trend. Adapting to innovation is difficult, but CFOs who have a strong insight into the world of automation will be well-positioned to succeed.

For those CFO’s who are currently utilizing RPA, it is critical to invest in building professional RPA skills to ensure that the technology is used effectively and that the department can fully utilize RPA’s capabilities.