Until last week, Netflix was right up there with Uber and Airbnb as sparkling examples of the bold new world of data-driven digital powerhouses.

Until last week, Netflix was a compelling case study in how businesses can collaborate intimately with customers to co-create superb experiences.

Until last week, Netflix was the “to” star in one of the classic “from/to” combos contrasting the dinosaurs of the past with the unicorns of the future: Blockbuster/Netflix.

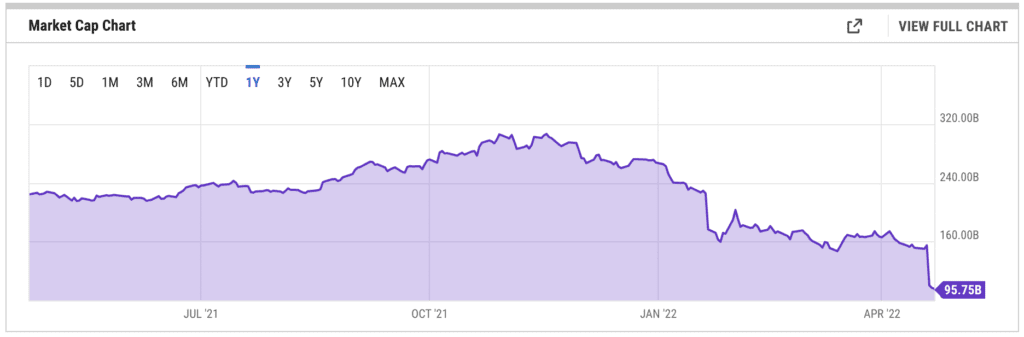

Until early last week, Netflix had a market cap of about $150 billion—but by Friday, that valuation had tanked by more than $50 billion to $99 billion.

Surely there’s a big lesson here—but what exactly is it?

First of all, Netflix remains a very successful company with excellent profits, a superb (if tarnished) brand, and outstanding global presence.

But—and whether or not you like big buts, this one’s about as big as a but can be—in our customer-driven world, even a company as celebrated and revered and glowed-over as Netflix will get the snot kicked out of it if it loses touch with its customers.

And that is the Netflix Nightmare writ large: after projecting that it would continue to add new subscribers at phenomenal rates in the first half of 2022—perhaps even as many as 2.7 million—Netflix is now projected to lose somewhere in the range of 2 million subscribers during that period.

Want to help ensure your company doesn’t fall out of step with your customers in the highly disruptive acceleration economy? Join us at Cloud Wars Expo in San Francisco June 28-29-30 to discover how world-class companies are forging closer ties with their customers, creating new ways of generating superb customer experiences, and deploying purpose-built industry clouds to thrive in today’s high-change world. You can register here—we look forward to seeing you at Cloud Wars Expo!

Hey, we all have our ups and downs, but that negative swing of close to -5,000,000 is a devastating blow to not just the Netflix market cap (which plunged more than $50 billion as a result of that unexpected reversal) but also to its mystique as some sort of gravity-defying, can-do-no-wrong company to which the laws of physics seemed not to apply.

And there’s the lesson: no company—no matter how big, how seemingly dominant, how glorified, or how highly valued—is immune to the fluctuating whims and desires and interests of its customers. No amount of financial “narrative” can whitewash the sudden and stunning reality of millions of customers and prospective customers losing interest and taking their money elsewhere.

Perhaps Netflix executives, awash in profits and projections and fawning media and analyst coverage, simply started to believe that their destiny was manifest. That they were not subject to the laws of gravity or the marketplace or the primacy of the customer. Or perhaps they believed that somehow, someway, people felt lucky and/or grateful just to have Netflix, and to have the opportunity to keep sending money to Netflix. Or to keep sending *more* money to Netflix as monthly subscription fees went up, even as many content providers took their content elsewhere.

To portray graphically just how stunning this nightmare really is, I’ve inserted below an excellent graphic from ycharts.com tracking the market cap for Netflix over the past 12 months. Like every company, Netflix has traversed the overall markets ups and downs during that time, so that’s not the point—rather, the point is what happened last week, which is shown on the right edge of the graphic.

But wait a minute—I thought Netflix was the ultimate “data-driven enterprise.” How many times have you read that Netflix has been so successful because it uses data to anticipate what customers will or won’t want to watch? I’m sure there’s a great deal of validity to those claims.

And that validity raises a much bigger and more important question.

Disaster Scenario #1

So wouldn’t a data-driven company—especially one that’s also a digital unicorn as sparkly and glowing as any you’ll ever come across—have anticipatory sensors out there on the customer-facing edges relaying back messages saying, “Warning, warning—the fee-payers aren’t pickin’ up what we’re puttin’ down!”

Did Netflix executives get blind-sided? Did they really not get feedback saying the golden goose—aka the customer—was getting fed up with stuff it didn’t want and so was packing its bags and heading elsewhere?

Did they not see this disaster coming?

Well, if they didn’t, then they should be fired for their abject failure to know what the hell was going on and their equally abject failure to be attuned to the marketplace that they serve. (Perhaps their previous success deluded them into believing that the marketplace was there to serve them.)

Disaster Scenario #2

Conversely, perhaps the leaders at Netflix were in fact getting real-time reports signaling or even predicting that subscription growth was not just slowing down but was heading off a precipice that would have horrendous implications for the company. Perhaps they saw the warnings and ignored them.

Perhaps they thought, “Hey, it’s just a blip—it’ll just be temporary and then all those subscribers will come back because, after all, we’re Netflix.”

As in the first scenario, these are fireable offenses of the first magnitude.

A lose-lose scenario

Either way—whether they didn’t know and got blindsided, or whether they did know and their arrogance took over—this is the object lesson for every business leader. Nobody owns first place—you are there temporarily with a short-term lease that the landlord (aka the customer) can pull at any time.

Netflix has blamed the disaster on price increases, Russia (it says it lost 700,000 subscribers there), competition, and account-sharing, and among that motley group of excuses the only one that holds any water is “blame Russia” (as ludicrous as that might sound in today’s times).

The others are simply so lame that anybody who dreamed them up—let alone put them out in public and expected to be taken seriously—should feel totally humiliated. Let’s take a look:

- Price increases: did Netflix execs figure that customers would like a price increase? Did they think, “Hey, we’re Netflix—they’ll be glad the price hike wasn’t bigger”? Did anyone at Netflix raise the issue that higher prices might lead to subscriber defections?

- Increased competition: Ah yes, the old “not my fault because we have competitors” line. This one’s as empty and useless as excuse #1.

- Account sharing: Okay, at least this one has some rational basis. But instead of setting out to put restrictions on customers in an increasingly unrestricted market, why not use some of that much-ballyhooed Netflix genius to come up with an entirely new type of plan that creates a win-win for customers who want to share accounts and for the provider that wants to be compensated for consumption? Don’t apply old-world approaches to new-world challenges!!

Final thoughts

Like I said, in spite of this nightmare, Netflix is a great company that’s in great shape, despite the financial pain investors are feeling in the wake of that $50-billion thrashing.

But over the past several months, the company’s leaders have made some terrible, terrible mistakes of omission or commission or both as outlined above. And people who made those types of mistakes once will surely make them again—so if Netflix wants to ensure that this nightmare does not become recurring, then it damn well better make some sweeping changes among its top executives.

And that should start with CEO Reed Hastings—if he’s not accountable for a drop in valuation of $50 billion, then who the hell is?

The CEO’s #1 job in today’s acceleration economy is to instill a top-to-bottom and end-to-end culture of customer-centric growth built on superb customer experiences.

And that’s the lesson every company can take from this Netflix Nightmare.

Want to gain more insights from Cloud Wars Expo?

Starting on July 20th, more than 40 hours of on-demand cloud education content will be available for free to Acceleration Economy Subscribers.