This SAPinsider Financial Close Transformation white paper dives into the benefits of automating reporting with technologies that improve efficiency and accuracy.

Cloud Reporting

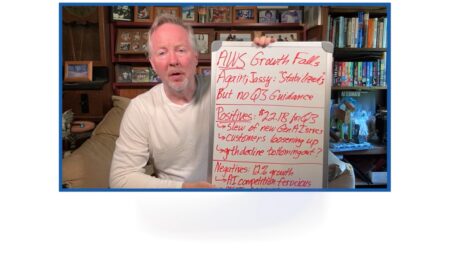

Its growth rate has declined over 18 months, but AWS remains a dominant cloud infrastructure force and customers benefit from its scale, focus on innovation, and generative AI strategy.

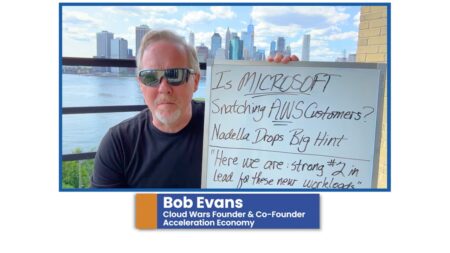

Business leaders are shifting from cost-cutting cloud optimization to investing in cloud migrations, data applications, and AI deployments. Microsoft is poised to capitalize.

In an interview with Oracle VP Jenny Tsai-Smith, discussions revolve around the upcoming Oracle Cloud World event, highlighting topics such as AI integration, Exadata advancements, and a focus on developers’ needs.

An update on the Cloud Confidence Index, with Amazon, Google, and SAP leading the index higher.

The Cloud Confidence Index uses market caps of top 10 cloud companies as a proxy for business leaders’ confidence in their growth, reflecting customer demand and technology trends. The index is up slightly.

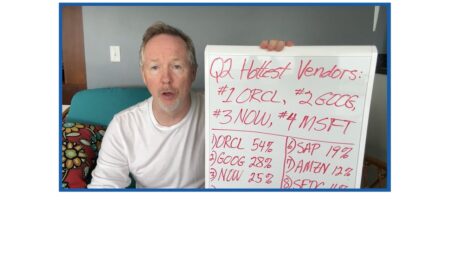

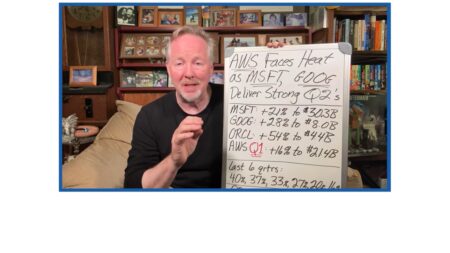

The four fastest growing cloud vendors’ financial results indicate an upturn in customer spending and preparation for the generative AI revolution.

Despite AWS’s impressive scale and achievements, its rivals are gaining ground in other software-centered segments of the cloud. AWS may face challenges in the Cloud Wars going forward.

Amazon Web Services (AWS) experienced a decline in its growth rate for the seventh straight quarter amid fierce competition from Microsoft, Google Cloud, and Oracle.

Microsoft is experiencing significant growth in the cloud infrastructure market, particularly in AI workloads, potentially taking market share from AWS, which has seen a decline in its growth rate.

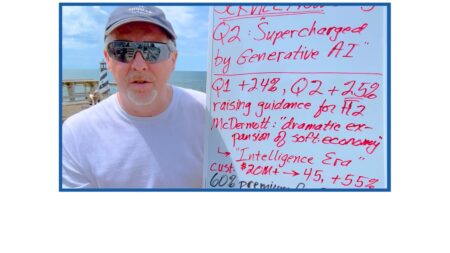

ServiceNow backs up it recent jump from #10 to #6 on the Cloud Wars Top 10 list with a strong financial performance and an optimistic outlook.

Generative AI is playing a central role in the powerful growth and earnings being reported by Cloud Wars Top 10 company ServiceNow.

AI capabilities, generative AI customer count, and operating profits are just three of the reasons that Google Cloud replaced AWS on the Cloud Wars Top 10 list.

Google Cloud’s latest quarterly results and strong growth validate its elevation to #2 on the Cloud Wars Top 10, while they also highlight its strength in supporting AI customers.

Approaching the release of the Q2 financial results of Amazon, AWS’ growth rate decline stands out relative to Cloud Wars Top 10 adversaries.

Google Cloud and Microsoft’s impressive Q2 growth rates suggest that AWS needs to turn up the heat to keep up in the Cloud Wars.

Celonis’ process mining software is expanding its reach across many businesses, with use cases applicable to supply chains, procurement, and more.

Bloomberg recently announced that its cloud-based data management solution is now driving a Snowflake-native app.

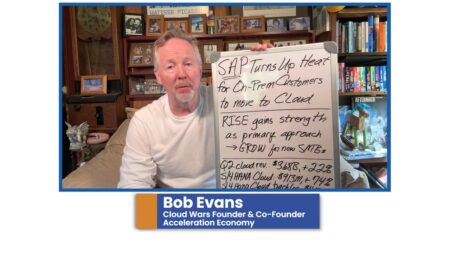

With its RISE with SAP program as a central force of customer innovation, SAP continues to deliver impressive cloud growth.

In order to access its latest innovations, SAP is requiring its 20,000 on-premises customers to move to the cloud. Get more details from SAP’s Q2 earnings.