Satya Nadella will almost certainly do an outstanding job as chairman Microsoft, it may still be overshadowed by his amazing record as CEO.

Top 10

Until recently, Google Cloud rarely talked about OCTO and philosophy, which to my knowledge is without peer among the Cloud Wars Top 10.

CEO Frank Slootman said on the recent Snowflake earnings call that Microsoft, Amazon and Google are “not sitting on good architecture.”

A newly assertive and re-energized IBM is moving in to extend and enrich its 50-year strategic relationship with SAP.

CEO Marc Benioff used his recent first quarter earnings call to explain how Salesforce’s transformation has it on a path to $50B in revenue.

Salesforce CEO Marc Benioff has proclaimed that his company will soon best SAP to become the world’s #1 provider of enterprise applications.

For Q1, Google + Amazon’s cloud revenues totaled $17.5 billion. Meanwhile, Microsoft posted Q1 cloud revenue of $17.7 billion, up 33%.

Introducing our new weekly rankings of the leading providers in a what could become a trillion-dollar category: the Industry Cloud Top 10.

Microsoft will release Q1 (its fiscal-Q3) numbers later today, and I see no indications that its rising rate of cloud growth will taper off.

SAP CEO Christian Klein and Oracle chairman Larry Ellison have very different views of which company is winning the cloud ERP battle.

I expect that next week’s Q1 earnings results will provide additional support for the clear winner of the Microsoft versus Amazon battle.

With every Top 10 company—particularly Google, Microsoft, SAP—declaring that industry clouds are a top priority, Salesforce has competition.

With Microsoft, Amazon and IBM generating $163 billion in 2021 cloud revenue together, the Cloud Wars leaders are raking in cash.

With an industry-cloud run rate of $1 billion, privately held Infor is among the cloud leaders for vertical apps and solutions.

Its disruptive impact and surging growth rates give Snowflake full credibility for inclusion among the Cloud Wars Top 10 companies.

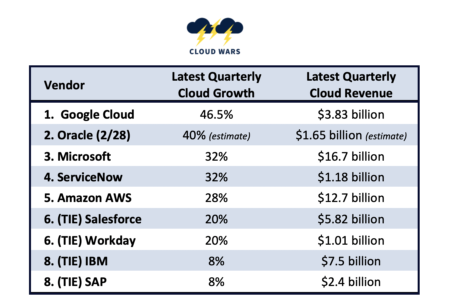

Assessing the world’s 9 most-influential cloud vendors’ growth rates, with Google Cloud’s 46.6% leading #2 Oracle and the rest.

SAP has a chance to bounce back aggressively in the wake of Wednesday’s jarring disclosures from Larry Ellison about customer defections.

Late last month, Nadella declared that the world’s #1 cloud vendor will intensify its “industry-first focus.”

In the Cloud Database Report, contributing editor John Foley describes the enormous upheaval & potential in this rapidly growing market.

Microsoft has reported that that its “remaining performance obligation” (RPO) for cloud reached a total of $112 billion, up 24%.