By combining AWS AI capabilities with NTT DATA’s delivery scale, the partnership accelerates legacy modernization and responsible AI adoption in highly regulated sectors worldwide.

AWS

Hyperscalers are facing soaring AI demand, with Microsoft, Oracle, AWS, and Google Cloud reporting a massive $1.63 trillion backlog in contracted business not yet recognized as revenue.

The hyperscalers’ record-breaking CapEx surge reflects real AI demand, not a bubble, as backlog growth across the Cloud Wars Top 10 hits historic highs.

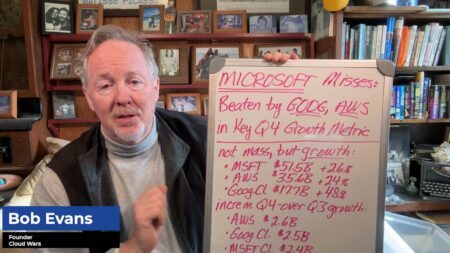

Google Cloud’s explosive Q4 growth surpassed Microsoft in incremental revenue, signaling a major shift in customer cloud spending and reshaping the Cloud Wars Top 10 rankings.

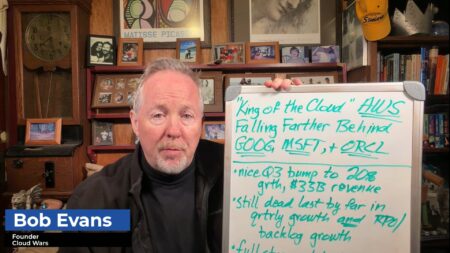

Despite a record-setting $35.6B quarter, AWS slid to #7 in the Cloud Wars as Google, Oracle, and Microsoft gained ground.

AWS announces general availability of its European Sovereign Cloud, expanding EU-only infrastructure while meeting strict data sovereignty requirements.

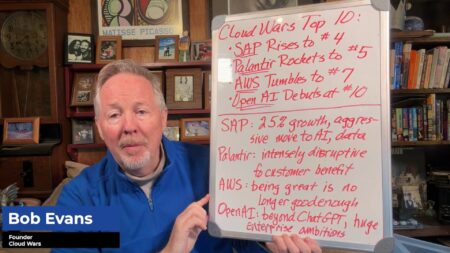

AWS tumbles to #7 as SAP climbs and Palantir rockets up the Cloud Wars rankings, reflecting shifting dynamics in the enterprise AI race.

Legacy tactics are fading as companies like Google Cloud and Palantir redefine what cloud leadership means in 2026.

Google Cloud is now the top-ranked cloud and AI provider, surpassing Microsoft and Oracle, thanks to bold leadership from CEO Thomas Kurian and a relentless focus on customer success in the AI economy.

Google Cloud’s deal with NATO marks a significant move into the defense sector, long dominated by AWS and Microsoft.

Palantir, Oracle, and Google Cloud dominate the Cloud Wars Growth Chart amid the AI Economy boom.

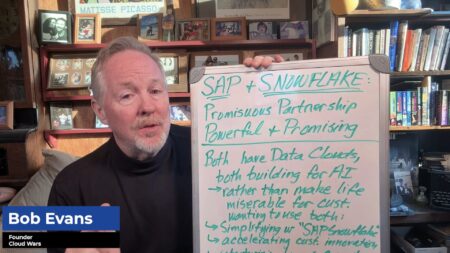

SAP and Snowflake have teamed up to create a unified platform that simplifies access to AI-ready business data for enterprise innovation.

In a shift from rivalry to alliance, SAP and Snowflake are teaming up to ease customer data challenges.

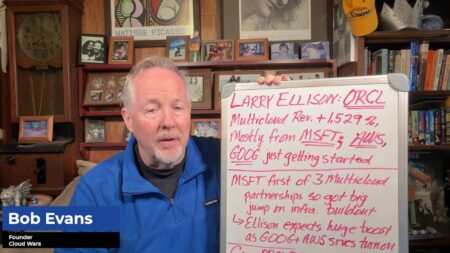

Oracle is using its multicloud partnerships with Microsoft, Google and AWS to reignite its core database business. It aims to reach $20 billion in revenue within five years by riding the AI inference wave and offering flexible multicloud deployment.

The Microsoft‑Oracle database partnership is generating nearly all of Oracle’s multi‑cloud database growth so far, with Larry Ellison believing AWS and Google Cloud will ramp up soon and drive the next wave of revenue.

AWS hit 20% growth in Q3, but Microsoft, Google Cloud, and Oracle outpaced it in AI-driven revenue and future backlog.

AWS, once the cloud pioneer, is now lagging behind Microsoft, Google, and Oracle in growth and innovation amid the AI Revolution.

Oracle’s cloud strategy blends full-stack engineering with aggressive AI and GPU expansion.

Google Cloud’s 46% Q3 backlog growth and Oracle’s 43% outpaced rivals, signaling rapid momentum shifts in the hyperscaler race.

Google Cloud is growing significantly faster than Microsoft and AWS, signaling a shift in who’s winning new AI business despite trailing in total revenue.