First appearing in 1997, the CAPTCHA test has been around since the early days of the internet. Passing the “Are…

Search Results: sales (2338)

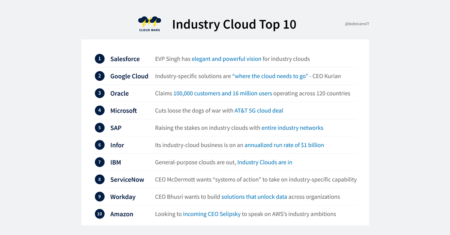

Chief Partner Officer Karl Fahrbach said co-innovation of cloud IP solutions is now the fastest-growing part of the SAP biz w/ partners.

https://www.youtube.com/watch?v=DfT_tk83bks In every Dynamics implementation, the biggest challenge lies in involving stakeholders and explaining how their work will be impacted.…

Visit the following link to Learn More Document generation consumes too much of your workday? Monotonous routine tasks such as document…

This week, Pat Fitzgerald and Mark Hatfield join me to talk about creativity in talent recruitment, contract recruiters and more.

The amount of data in the workplace is widely available. Businesses can view an endless stream of data, whether it’s…

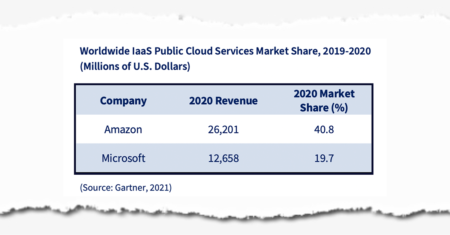

Late this month we’ll find out if Google Cloud and Amazon (together) are finally able to best Microsoft in cloud revenue for Q2.

Optimization is important. It is a goal shared by all businesses, for it is the only way to grow. As…

Selling its enterprise-asset management business for about $2.75B, including $800M in cash, Infor can supercharge its industry cloud services.

Customers across every industry are looking for digital-first relationships, and companies are accelerating transformation initiatives to keep up. Salesforce’s top…

You’ve done your research. You know your corporate indirect tax department could benefit from comprehensive tax technology. You’ve looked into software options and started building your business case. However, the most critical question remains: How are you going to fund the investment?

If you know where to look, you’ll uncover costs that will more than justify the decision to purchase comprehensive indirect tax software to manage your global sales and use taxes, value-added taxes (VAT), and goods and services taxes (GST). Here we take a look at several areas where potential time and cost savings overwhelmingly validate the investment in indirect tax technology.

The “legacy” impact at Google Cloud has just intensified as Rob Enslin has hired Adaire Fox-Martin to become president of EMEA.

Flexing its industry cloud muscles, the world’s most-influential cloud provider Microsoft has taken over #4 on the Industry Cloud Top 10.

Within the careful press release about AT&T moving its 5G mobile network to the Microsoft Azure for Operators cloud is another message.

A 3-hour digital event designed to help you eliminate months’ worth of time-intensive research with this event designed to help IT, Finance, Operations and Business leaders create a competitive advantage in the acceleration economy.

Taking the time to map your customer journey is a great way to help you better target your marketing, support…

Gartner has just released its guesses regarding 2020 worldwide IaaS public-cloud market shares, and I have a few questions.

2021 is here! After a roller coaster 2020, its time to take stock of the situation and plan accordingly for…

ANCA is one of the leading companies specializing in designing and building CNC grinding machines across the globe. One of…

Satya Nadella will almost certainly do an outstanding job as chairman Microsoft, it may still be overshadowed by his amazing record as CEO.