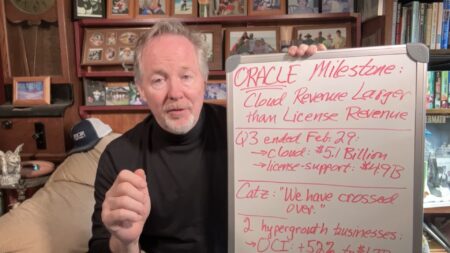

Oracle’s fiscal-Q3 earnings reveal a groundbreaking shift as cloud revenue overtakes traditional licensing, signaling a transformative era in the tech giant’s business strategy

Search Results: cloud infrastructure (1504)

SAP intensifies focus on data with GenAI capabilities in Datasphere, refraining from “data cloud” terminology despite potential customer alignment.

The moves by Microsoft, Google Cloud, and Amazon to eliminate data-egress fees represents a significant victory for business clients, with Oracle also playing a role, alongside the impetus from impending EU data regulations.

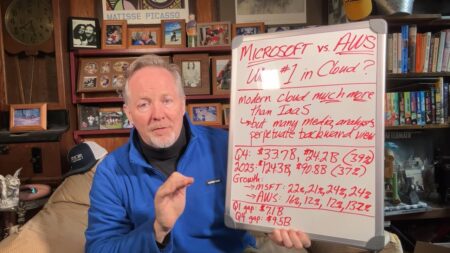

Has Microsoft surpassed AWS as the leader in the enterprise cloud? Financial figures show Microsoft’s cloud revenue consistently outpacing AWS.

There’s a case to be made that Microsoft has become the largest and most influential cloud vendor globally, surpassing AWS.

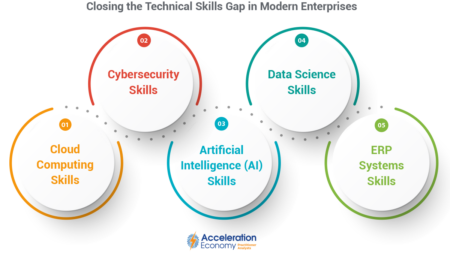

In order to prepare companies for the future of technology-driven business, it’s incumbent upon CIOs to identify and actively address the most critical tech skills gaps.

Andy Jassy claims AWS had the cloud market’s highest incremental revenue gain, overlooking Microsoft’s superior figures, leading to questions about his perception of cloud services.

Amazon CEO Andy Jassy’s remarks on cloud providers raise questions about whether the company is evolving in line with customer requirements.

Google boosts investments, allocating $11 billion in Q4 2023 and eyeing $50 billion in 2024 for technical infrastructure, fueled by the GenAI Revolution and Gemini AI models.

Google Cloud and Kyndryl bring their respective platforms and services together to help customers drive GenAI results and do so responsibly.

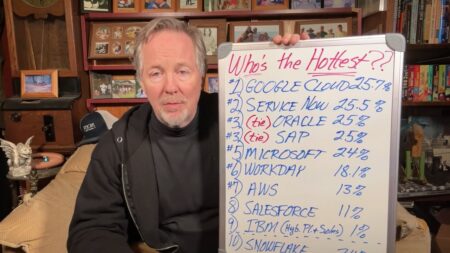

Google Cloud has a narrow lead on the Cloud Wars growth chart; Microsoft’s growth is remarkable; and the GenAI Revolution continues to impact the top cloud vendors.

AWS, once the undisputed leader, is struggling to keep pace with the rapid growth and customer-focused innovations of Microsoft, Google, and Oracle in the cloud market.

The cloud hyperscalers are splitting into two distinct groups: sprinters (Microsoft, Google Cloud, and Oracle) and plodders (AWS).

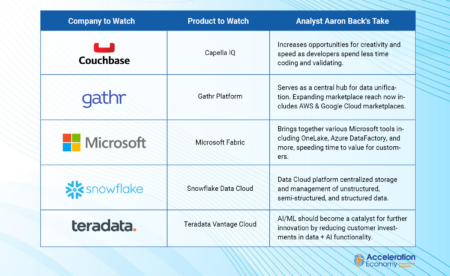

Discover our 5 data products to watch — from Couchbase, Gathr, Microsoft, Snowflake, and Teradata — and how they can support your company’s AI strategy in 2024.

In 2024, the challenges of AI adoption, cloud migration, and cultural shifts take center stage for CIOs striving to align IT with business.

CEO Safra Catz shares insights on how Oracle meets customer needs through its cloud infrastructure and applications, as well partnerships with other cloud providers.

Larry Ellison and Safra Catz of Oracle express confidence in the cloud business, citing robust growth and high demand for Oracle Cloud Infrastructure (OCI) among other factors.

The case for Oracle’s optimistic outlook for 2024, including strong demand for Oracle Cloud infrastructure, AI leadership, and its global data center strategy.

Research from Cockroach Labs cites multi-cloud challenges including integration and cost, despite compliance and resiliency benefits.

Oracle experiences a notable slowdown in its cloud growth rate, dropping to 25% in fiscal-Q2 with $4.8 billion in revenue, signaling a shift from previous quarters’ 30% or higher growth.