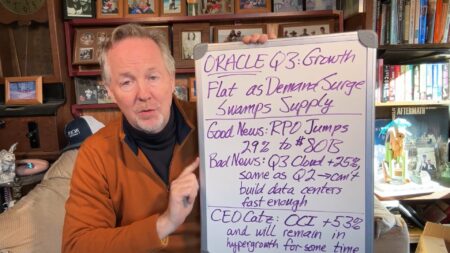

Oracle’s Q3 results reveal both challenges in meeting cloud infrastructure demand and ongoing success in securing large deals.

Search Results: ai data (4988)

Oracle is expected to deliver a 51% increase in Q3 cloud-infrastructure revenue, underlining its prowess in attracting major clients and reshaping industry dynamics.

Insights into Oracle’s fiscal Q3 results, which are likely to reveal remarkable growth for Oracle Cloud Infrastructure (OCI).

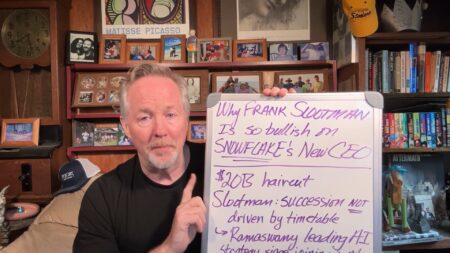

Frank Slootman’s successor as Snowflake CEO, Sridar Ramaswamy, brings a strong AI background and strategic vision to drive the company forward.

SignUp Software CEO Olof Hedin provides insights on market trends and describes how those trends impact the Office of the CFO today.

Snowflake’s Frank Slootman steps aside as CEO and the company appoints new CEO Sridhar Ramaswamy at a pivotal moment, with the importance of AI increasing rapidly.

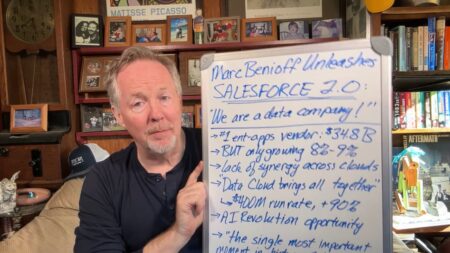

Salesforce introduces Einstein Copilot, a GenAI offering leveraging proprietary company data to provide contextual answers within CRM applications.

Salesforce is making a strategic shift towards prioritizing higher margins over growth, which entails a new focus on its identity as a data company and addressing challenges in synergy among its legacy clouds.

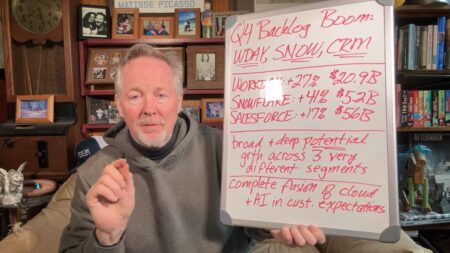

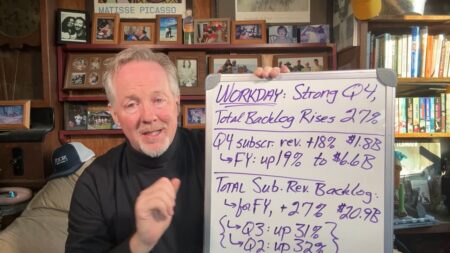

Businesses exhibit strong confidence in cloud and AI, reflected in soaring RPO and backlog figures from Workday, Snowflake, and Salesforce. Substantial long-term commitments highlight aggressive investments in these companies’ software.

Recent earnings reports from Workday, Snowflake, and Salesforce show strong future bookings across diverse market positions.

Gutsy redefines cybersecurity with process mining, a strategic tool that integrates people, processes, and technology to offer data-driven insights.

Workday’s recent strong fiscal performance includes impressive subscription revenue growth and substantial backlog.

Has Microsoft surpassed AWS as the leader in the enterprise cloud? Financial figures show Microsoft’s cloud revenue consistently outpacing AWS.

Highlighting optimistic subscription-revenue trends for Workday, decoding Salesforce’s cautiously optimistic signals for a potential growth turnaround, and expecting continued strong growth for Snowflake driven by AI and expanding data initiatives.

Andy Jassy claims AWS had the cloud market’s highest incremental revenue gain, overlooking Microsoft’s superior figures, leading to questions about his perception of cloud services.

RaceTrac utilizes Workday’s adaptable platform for quick integration of new data, effective module interaction, and prompt implementation of changes.

Amazon CEO Andy Jassy’s remarks on cloud providers raise questions about whether the company is evolving in line with customer requirements.

SignUp Software maintains a laser focus on accounts payable automation for Microsoft customers, while addressing their cost, compliance, and control requirements.

The NFL has continued its partnership with AWS to develop tools using AI and machine learning to advance analytics in the sports industry, and AWS’ technology will feature prominently in the Super Bowl.

In an exclusive interview, ServiceNow CEO Bill McDermott explains his company’s big platform advantages, compelling GenAI use cases, and how his team engages with the C-suite.