Innovation is born from diversification in thought, ideas, and passions. We have come a long way to close the gap for women in technology. However, we still have a long way to go. So, what can we do?

Search Results: HR (7807)

Customers across every industry are looking for digital-first relationships, and companies are accelerating transformation initiatives to keep up. Salesforce’s top…

You’ve done your research. You know your corporate indirect tax department could benefit from comprehensive tax technology. You’ve looked into software options and started building your business case. However, the most critical question remains: How are you going to fund the investment?

If you know where to look, you’ll uncover costs that will more than justify the decision to purchase comprehensive indirect tax software to manage your global sales and use taxes, value-added taxes (VAT), and goods and services taxes (GST). Here we take a look at several areas where potential time and cost savings overwhelmingly validate the investment in indirect tax technology.

How do you sort through all the choices and find the right software vendor to automate your indirect tax process? Use these questions as you evaluate vendors. The software vendor that provides the most items in the list will best support your indirect tax automation needs.

Cloud software solutions eliminate the burden of system administration and maintenance so management can focus on value-added activities. They remove the need for IT teams to manage on-premise implementations that are tough to forecast from a resourcing perspective. They reduce costs significantly while providing better service, more agility and greater security.

Most modern corporations whose goal is to stay tax compliant decide to use integrated tax software. It is the only way to automate the end-to-end tax automation process and allow your indirect tax department to spend more time on the activities that bring value to your business.

This whitepaper shows how these corporations benefit from integrated tax software and how it helps them stay tax compliant.

In a new episode of the Tax & Tech Talks podcast series, experts from KPMG and Thomson Reuters discuss how companies are turning to automation and analytics software to stay ahead of changes buffeting indirect tax management.

The “legacy” impact at Google Cloud has just intensified as Rob Enslin has hired Adaire Fox-Martin to become president of EMEA.

Optimal connectivity will continue to play a crucial role in the digital world whether IoT, edge computing, cloud apps and more. How will businesses adapt to this change?

Adams Land & Cattle is an agribusiness based in Nebraska specializing in crops and beef while focusing on food safety,…

In this Cloud Wars Live episode, I talk with Bonnie Tinder about the immense opportunity for channel partners as the cloud continues to grow.

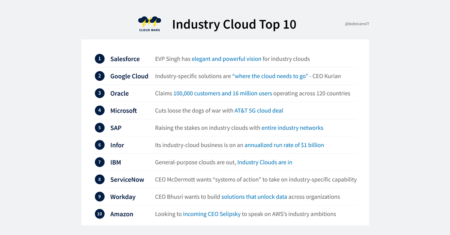

Flexing its industry cloud muscles, the world’s most-influential cloud provider Microsoft has taken over #4 on the Industry Cloud Top 10.

On average, about half of companies say they have yet to realize substantial value from their cloud investments, found a…

Summit North America 2021 is truly shaped by community feedback, and the planning committee members are the heart of the event experience

Security is a foundation of any application and optimal network environment. What role does biometrics play in a passwordless future?

Within the careful press release about AT&T moving its 5G mobile network to the Microsoft Azure for Operators cloud is another message.

Data governance campaigns should be fluid and pragmatic. Learn three keys to creating a successful, frictionless, and understandable process.

The full extent of how RPA and AI will be leveraged has yet to be fully realized. But, what can we learn from how they have been used so far?

On this Cloud Wars Live podcast, Sean Ammirati and I talk through the explosive industry cloud market. Plus, Amazon and AWS, vaccines & more.

In this analysis by Pablo Moreno, explore how Artificial Intelligence is impacting and future-proofing the legal practice