Account structures in Dynamics 365 for Finance use the main account and financial dimensions to create a set of rules that determine the order and values used when entering the account number. D365 for Finance allows you to set up as many account structures as you need for your business. Account structures can limit the account and dimension combinations to ensure that only correct groupings are permitted. This allows you to limit the combinations that are used by others to create purchase orders, input invoice vouchers, create ledger entries, or input time-sheets. By creating these limitations, you don’t have to reconcile and re-class journals if the wrong combinations of ledger and dimensions are accidentally used, which saves time on the back-end of the process.

Account Structures

Account structures require the main account. The main account does not need to be the first segment in the structure, but it does identify what account structure is being used during the account number entry. Therefore, the main account value can only exist in one structure assigned to the ledger so that they do not overlap. After the account structure is identified, the allowed values list is filtered to guide the user through picking only valid dimension values, decreasing the possibility of an incorrect journal entry. Most companies have a Balance Sheet and a P&L structure, but you can have many account structures based on how you organize your ledger accounts. These account structures consider the main account selected, then supply the available dimensions.

Example

To illustrate setting up an account structure, let’s assume that a company wants to track their balance sheet accounts (100000..399999) at the account and business unit financial dimension level. For revenue and expense accounts (400000..999999), they track financial dimensions Business Unit, Department, and Cost center. If they make a sale, they also track Customer. In this scenario, it is recommended to have two account structures assigned to the company’s ledger – one for Balance sheet accounts and one for Profit and Loss accounts. To optimize the user experience, Customer should be an advanced rule that is only used when a sales account is used.

Segments and Allowed Values

When creating an account structure, the maximum number of segments is 11. If you need more segments, thoroughly evaluate your setup and requirements, as it will impact the user experience. Consider if a segment can be derived in a reporting scenario using a hierarchy instead of during data entry. If you determine that more than 11 segments are needed, you can add additional segments using advanced rules.

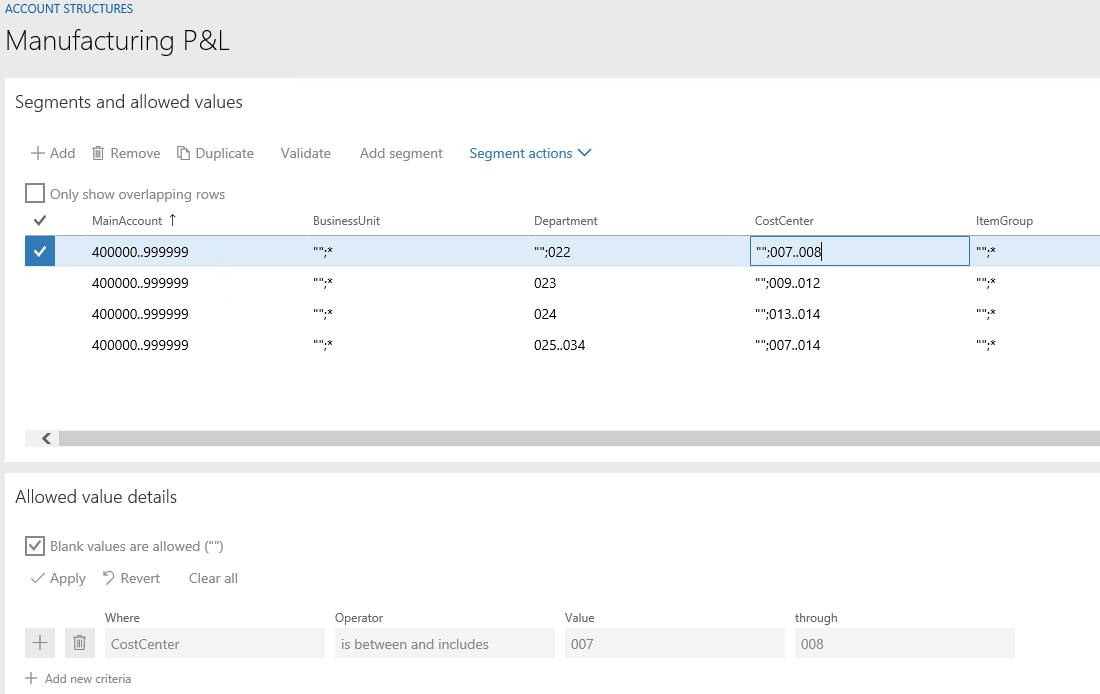

The Segments and Allowed values details section provides a grid-like experience for entering the rules that will be followed on validation during posting. You can type directly in the cells in the grid, import it from Excel, or use the Allowed value details section to guide you through it.

The Allowed value details section guides you through creating criteria using Operators such as begins with, is between, includes, and many others.

Best Practices

- Make the main account first so that users get the best-guided experience they can during account entry.

- Reuse account structures as much as possible to reduce maintenance across your legal entities.

- For variations across legal entities, consider using advanced rules so that account structures can be reused.

- When defining allowed values, use ranges and wildcards as much as possible.

- Do not just put an asterisk for every segment in the account structure. This can be difficult to manage and often leads to user error during maintenance.

Next Steps

If you are interested in learning more about creating account structures as well as maximizing the use of Microsoft Dynamics 365 for Finance contact us here to find out how we can help you grow your business. You can also email us at info@loganconsulting.com or call (312) 345-8817.