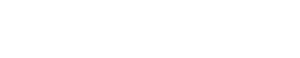

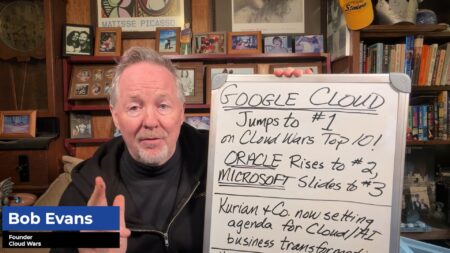

Microsoft drops from #1 to #3 in the Cloud Wars Top 10 as deep cybersecurity failures outweigh record cloud revenue, reshaping the rankings.

Claude’s integration into Microsoft Foundry allows healthcare organizations to utilize domain-specific tools to streamline operations and improve patient outcomes.

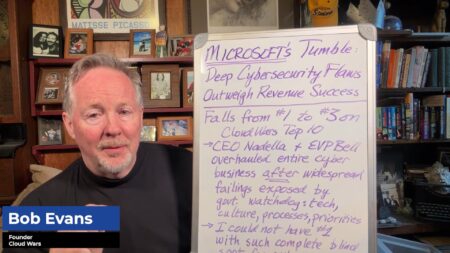

Oracle’s rise to #2 in the Cloud Wars Top 10 rankings is driven by AI innovation, cloud growth, and strong execution from leadership.

From checkout functionality integrated into Copilot to personalized shopping to AI automation in store operations, Microsoft delivers a range of AI tools that modernize online retail.

Siefert and Bacon discuss how the AI Agent & Copilot Summit has evolved from introducing AI concepts to focusing on real-world, production-ready use cases that deliver measurable business value across industries.

Google expands its Gemini 3 model family with Gemini 3 Flash, a high-speed, cost-efficient AI model designed for low-latency, near real-time processing, multimodal applications, and AI-driven coding.

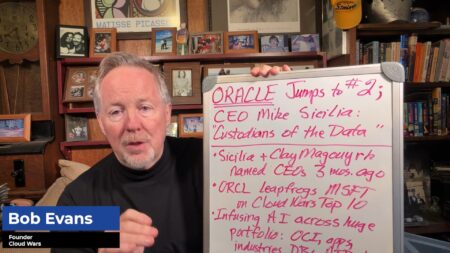

In the evolving AI economy, Google Cloud has surged to the top of the Cloud Wars rankings by focusing on customer outcomes and transformation, rather than just tech superiority.

Defender enhancements include services, dedicated engineering resources for proactive and reactive threat defenses, as well as strengthening overall security posture for the AI Era.

The Microsoft CEO urges moving beyond the hype to systemic AI architectures that can scale human ambitions.

Koen Cuypers of SignUp Software shares how AI can optimize business processes and ERP functions, and details the company’s roadmap for 2026.

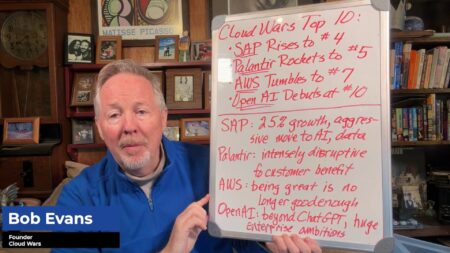

Legacy tactics are fading as companies like Google Cloud and Palantir redefine what cloud leadership means in 2026.

AI agents can eliminate mundane, repetitive tasks—like documentation and customer data lookup—freeing professionals to focus on higher-value, growth-oriented work.

After four years of Microsoft dominance, the Cloud Wars rankings now feature Google Cloud at the top, showcasing a new leader in cloud innovation and enterprise transformation.

GPT-5.2 is now live in Microsoft Foundry, empowering developers with smarter, more reliable AI agents and scalable outputs.

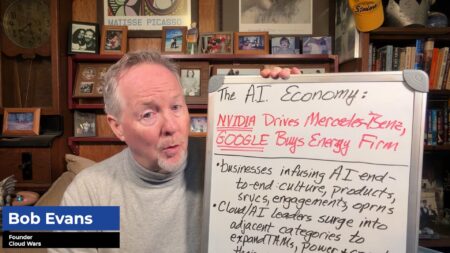

AI is no longer just a buzzword, it’s a new economic paradigm. With AI reshaping retail, automotive, and energy, leaders must choose between innovation or obsolescence.

Columbus VP, Michael Simms, joins the AI Agent & Copilot Podcast to share what went into selecting the sessions for the 2026 event, and what’s required to successfully adopt AI.

The speakers and sessions for the 2026 AI Agent & Copilot Summit have been announced by event producers, Dynamic Communities and Cloud Wars.

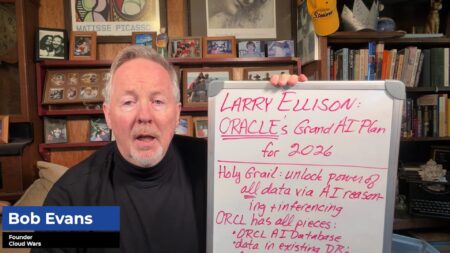

Oracle is merging its legacy databases, apps, and infrastructure into an all-inclusive AI stack to dominate the fast-growing AI economy, according to Larry Ellison’s recent earnings call.

St. Jude Children’s Hospital leader explains how AI tools enhance donor engagement, while authentic relationships remain at the core of fundraising.

IBM and Pearson have partnered to build AI-powered personalized learning tools using watsonx Orchestrate and watsonx Governance to serve businesses, governments, and educators.