We are in the current rise of an innovation wave of artificial intelligence (AI) technologies. We already encounter them in our daily lives: Alexa and Siri, booking platforms, translation services, voice-to-text capabilities, Netflix and Youtube recommendation algorithms, and the increasing use of intelligent chatbots for customer service.

Big retailers and fast-moving consumer goods (FMCG) companies are already trying AI technologies such as machine learning and computer vision to improve their retail execution, reduce out-of-stocks and even monitor their competition. Still, these AI solutions are based on cutting-edge technologies, and as such, sometimes early adopters find “bumps” on the road. For example, maybe the solution does not actually provide real-time data, preventing the staff from taking action on the spot. Or internet connectivity problems impair data processing on the cloud, hindering in-store execution. There can also be issues regarding technology-centric pricing models that do not adjust to industry needs. In fact, sometimes the new technology underperforms compared to their current technology.

So why are the biggest CPGs and retailers still investing in AI?

The reason CPGs and retailers continue to invest in AI is because they understand that AI is not a temporary trend but a disruptive technology.

As Clayton Christensen explained in his seminal book The Innovator’s Dilemma, disruptive technologies bring a very different value proposition than what was previously available. Disruptive technologies permanently change the way companies operate, do business, and satisfy their consumers.

Take the cellular phone, one of the best examples of disruptive technology. From its humble beginnings as a clunky, heavy artifact with limited functionality, it quickly became a worldwide enabler of global commerce and communications.

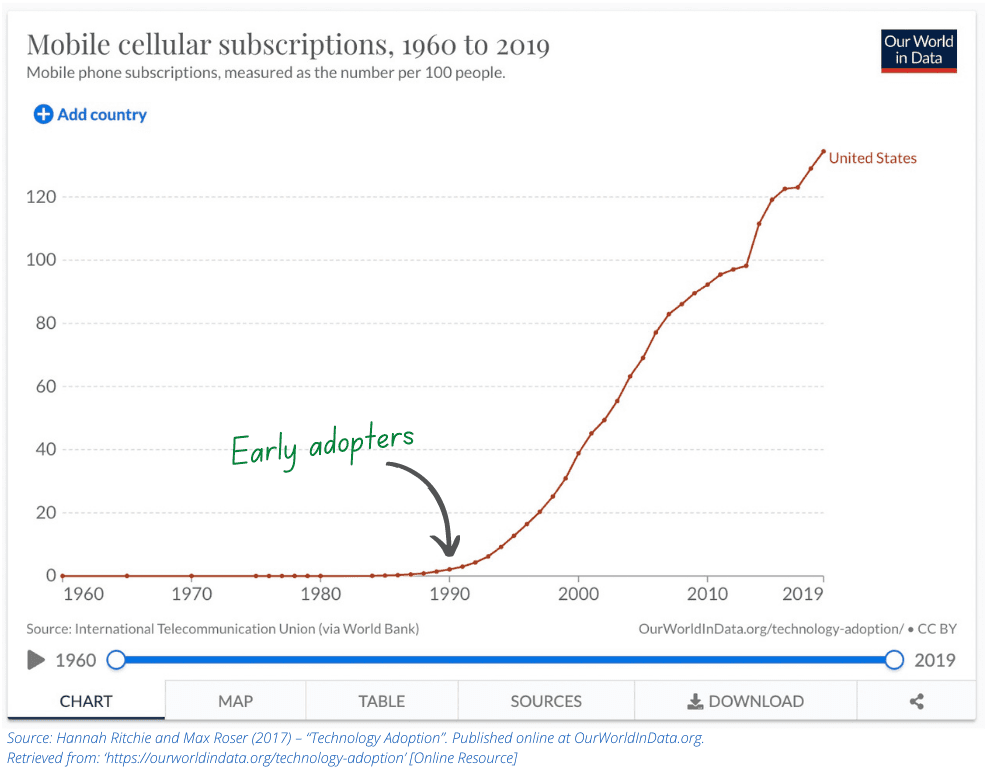

The following chart, which shows the adoption of cellular technology through the years, also characterizes how disruptive technologies evolve.

First, these technologies only bring value to niche markets, so the adoption is negligible. Later on, improvements make the technology appealing to a larger consumer base (the early adopters). At this point, it is still catching up with existing technologies. Finally, the rate of improvement accelerates, outperforming current technologies and going mainstream.

AI technologies will follow a very similar adoption curve. Right now, we are at the inflection point, just before a larger adoption begins.

In the cellular technology case, the inflection point came when breakthroughs in microelectronics made it possible to build smaller microprocessors with higher computational power. For AI, the inflection point occurred when accessibility of sophisticated computational power (cloud computing), the ability to produce and handle vast amounts of data, and advanced machine learning algorithms converged.

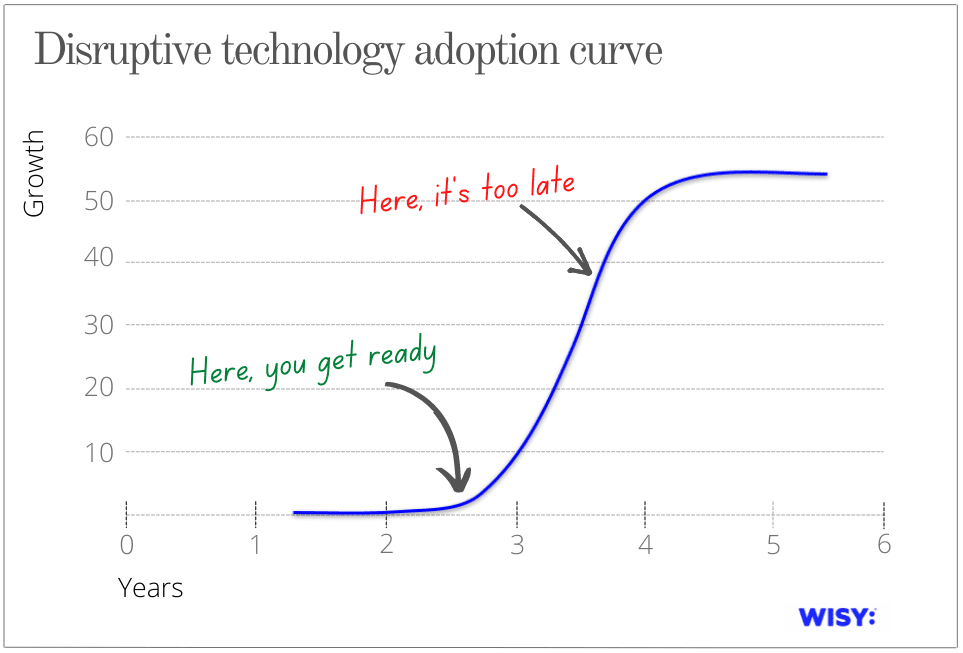

Why jumping into AI early in the curve is the right choice?

Jumping early in the curve is the right choice because early adopters fare much better than late adopters. They will be ready when market expectations and competencies shift due to the mainstream adoption of disruptive technology. AI will open a door for business opportunities not yet fathomed, and only companies in the forefront will be able to see those opportunities and leverage them.

There is also an advantage for early adopters from the standpoint of attracting and retaining talent. AI technologies are already part of daily life, and soon they will also be a part of workplaces everywhere. Candidates will expect these tools to do their daily jobs, and a company that does not provide them could be regarded as falling behind.

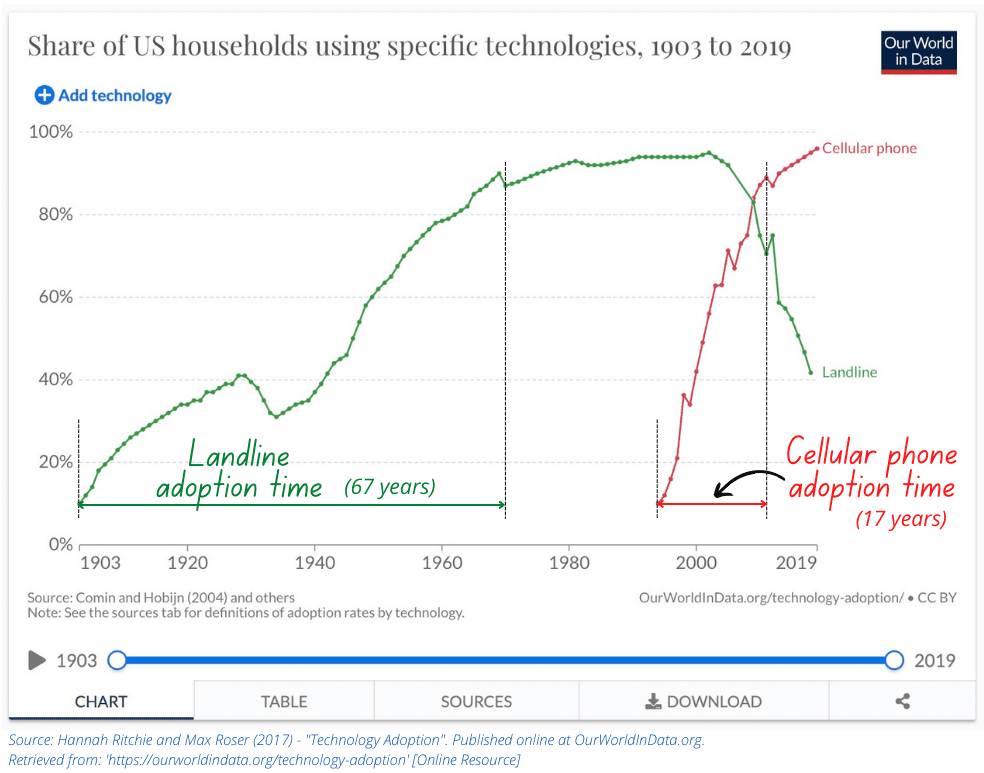

The window for early adopters will not last long because each new disruptive technology has a shorter adoption time. Take, for example, the adoption of the cellular phone compared to the previous technology, the landline, as shown in the following chart.

The landline took 67 years. The cellular phone took 17 years. AI will take much less.

AI has been overestimated with futuristic visions of robots taking away people’s jobs or underestimated, thinking that it is a sophisticated tool to help sales reps count facings faster. Both arguments have missed the point.

Imagine if your AI platform could automatically tell you the best seasonal assortment by location and by store. Imagine having the AI platform suggest planograms for each of your stores depending on location and consumer insights from that store. Imagine if it could tell you in advance the success rate of a product rebranding or what flavors you should produce next according to worldwide consumer trends. Those things will be possible. That’s the road AI is paving for the consumer goods industry.

To delight consumers in the following decades will require a high amount of operational complexity, which AI technologies can handle nicely. It will also bring opportunities, but only for those who are ready.

It is vital for FMCG companies and retailers to start thinking about AI’s value proposition for their businesses, first as an operational improvement and then as a competitive advantage.

If you are interested in understanding the value AI can bring into your business now and in the near future, drop us a line at hello@wisy.ai.