Many people fear the tectonic shifts in the labor market that artificial intelligence (AI) is bringing, but there’s one area most of us would agree that finance could use more, not less, automation.

From doing taxes to filing invoices to arguing on the phone with bank customer-service reps, we can all think of tasks that neither we, nor the people doing them for a living, like very much. Well, maybe some people do; I just don’t know any of them.

To hear practitioner and platform insights on how solutions such as ChatGPT will impact the future of work, customer experience, data strategy, and cybersecurity, make sure to register for your on-demand pass to Acceleration Economy’s Generative AI Digital Summit.

Fortunately or unfortunately, everyone has a connection to finance. Every adult does taxes. Every company relies on accounting. The problem is that not everyone likes to deal with numbers and sift through the minutiae of financial tasks. And certainly, not everyone likes poring over large documents searching for clauses or numbers to figure out what to do and when to do it.

Fortunately, these are exactly the types of information that large language models (LLMs) like GPT-4 are adept at digesting and reformulating in a human-friendly way. They can turn numbers into words and large, unwieldy documents into conversations.

Recently we saw the release of OpenAI’s GPT-4, the successor to GPT-3.5 which was the model underlying the popular AI chat tool ChatGPT. GPT-4 allows less financially literate people to make better decisions and avoid costly mistakes. For example, I used the tool to help me complete my taxes. It did the heavy lifting of defining words, finding out local tax requirements, and understanding my unique situation. I made sure to run through the calculations it completed to ensure the results were correct.

Ideally, companies and employees would let their finances run silently in the background as they focus on their actual work. To understand how LLMs are helping enable that reality, let’s dive into some real-world examples of companies using GPT-4 to optimize finance processes within the finance industry itself, with the goals of serving customers better and running internal operations more fluidly.

Morgan Stanley Improves Wealth Management Services

Morgan Stanley has been around for almost a century. In that time, the firm has built an enormous library of IP and assets that wealth managers use to deliver value to clients. However, navigating that library isn’t easy or efficient, and it slows down the wealth management team while forcing clients to wait longer.

So Morgan Stanley built a chatbot trained on a library using GPT-4. This tool lets everyone in the firm quickly access the right information. “You essentially have the knowledge of the most knowledgeable person in Wealth Management — instantly,” says Jeff McMillan, Head of Analytics, Data & Innovation. “Think of it as having our Chief Investment Strategist, Chief Global Economist, Global Equities Strategist, and every other analyst around the globe on call for every advisor, every day. We believe that is a transformative capability for our company.”

Morgan Stanley’s GPT-4 use case is also an excellent example of how humans are augmented, not replaced, by AI. Their advisors communicate with clients to understand their unique situation, which GPT-4 may not be able to grasp. Then, advisors use GPT-4 as a tool to gather information and make the connections between data points to present only the information that is most valuable to the client. Humans also play a critical role in fact-checking and double-checking to minimize errors and biases emanating from current tools like GPT-4.

According to the case study posted on OpenAI’s website, more than 200 Morgan Stanley employees are already querying its GPT-4-enabled system on a daily basis. As a result, these advisors can provide more relevant information to their clients with a much shorter turnaround than searching through the library manually.

Stripe Drives Results Across Business Processes

Stripe is a payment processing company that helps people send and receive money online. Its main users are developers who integrate Stripe’s services into websites, applications, and more. That’s why streamlining the process of integrating Stripe for developers is mission-critical for revenue growth.

Previously, these developers had to manually sift through documentation to find the answers they needed. This can take very long and lead to suboptimal code if answers aren’t found. To tackle this problem, Stripe decided to use GPT-4 to crawl its developer documentation and power a chat tool that developers use to ask questions, no matter how specific or unique. (OpenAI details this work in its customer case study on Stripe).

GPT-4 also has the ability to generate code in almost any language. This lets developers gain a solid starting point and even allows non-technical people to integrate Stripe into their tech stack using natural language queries.

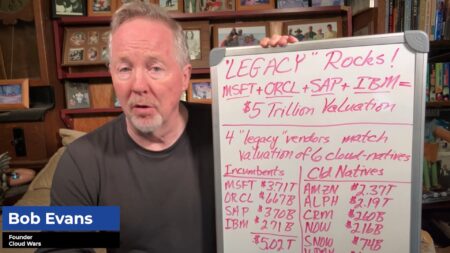

Which companies are the most important vendors in AI and hyperautomation? Check out the Acceleration Economy AI/Hyperautomation Top 10 Shortlist.

Stripe uses GPT-4 to more quickly crawl the websites of the businesses that use its services. Previously, the company had staff searching through websites manually to understand the unique needs of customers as a way of guiding product development. With GPT-4, however, the Stripe team can receive quick summaries of each business and how Stripe could be used more effectively within that business. This process also improves Stripe’s customer service.

Finally, Stripe uses GPT-4 for fraud and content moderation on Discord. LLMs’ unique capability of understanding natural language is critical in helping manage large online communities like theirs. This improves the quality of the community and helps maintain the Stripe brand.

Specialty Industries and Jobs Are Changing Rapidly

GPT-4’s ability to handle natural language, images, and numbers in combination allows it to support use cases in many fields, including finance and business.

Morgan Stanley’s use of GPT-4 illustrates the potential for automation in financial advisory services and the coming democratization of information that previously only specialists in law, finance, or certain industries could handle. I can personally attest to how useful ChatGPT was in my most recent tax filings. Sure, you should run the numbers yourself and these systems work best in combination with a smart human advisor. That doesn’t mean LLMs aren’t changing the game. Firms that aren’t rapidly reshaping themselves around these tools are taking a serious risk of being left behind.

Final Thoughts

I’ll leave you with this closing thought: What if the suggestions of an LLM could be translated into reality without the need for a human intermediary? What if you were to tie an LLM into your ERP, bank account, Slack, or other system?

The potential efficiency boost is obvious, but so is the danger of integrating such systems. Errors and biases that are currently limited to GPT-4’s text output would propagate across a company’s operations. It might also be difficult to shut off. Not to mention these systems are already showing signs of self-preservation and self-improvement that will result in ever greater intelligence. At the risk of sounding like a luddite, I think anyone deploying or considering GPT-4 should tread carefully.

Looking for real-world insights into artificial intelligence and hyperautomation? Subscribe to the AI and Hyperautomation channel: