AI has touched every industry. One application area less talked about, but relevant for anyone participating in the modern financial world, is banking. Recently, a wave of innovative startups have begun to address new AI use cases in this sector. We’ve also seen established financial institutions adopting the tech. With the development of more use cases and demonstrated interest from big institutions, the AI ecosystem has been connecting into the banking industry more and more.

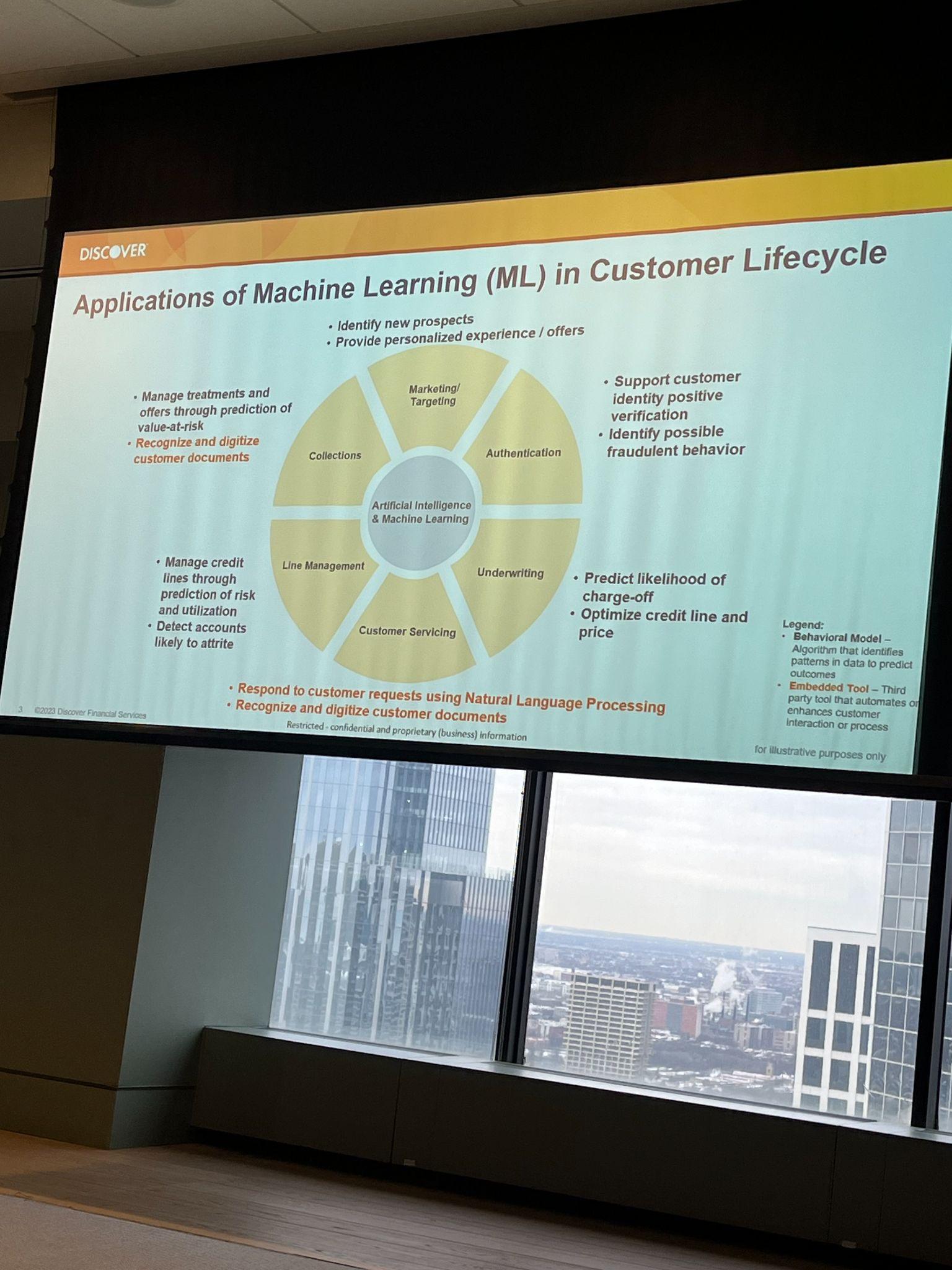

Core machine learning (ML) has been a part of the banking world for quite some time. As data-driven organizations, banks need a quantitative understanding of their customers to make lending decisions. Because of this, banking institutions have long used technology to better analyze data across the customer lifecycle.

Recently, banks started exploring the use of GenAI as well, especially in customer-facing workflows. Below I’ll break down key application areas of AI/ML for banks and how GenAI may be applied as well.

Authentication

The know-your-customer, or KYC, process has long used computer vision to scan faces and identification documents. This process alone has saved banks billions in fraud and kept financial systems secure. ML is also used to identify fraudulent behavior across the customer lifecycle.

Underwriting & Loans

Underwriting refers to the process through which banks make loan decisions. It boils down to knowing which customers are most likely to repay their debts and approving the proper amount of credit. As time goes on and factors change, the risk of repayment also changes and needs re-evaluation. This is one of the first applications of ML for banks.

On the customer side, banks are exploring the use of GenAI-powered chatbots to help people apply for loans. Right now, the process is long and painful, with both parties sending documents back and forth. Customers may also need explanations of certain terms, rates, or concepts. Banks usually employ full-time loan officers for this task. With GenAI, banks can automate the first stage of the loan application process by giving customers a portal that can answer any questions 24/7 and guide them through the application process.

One innovative startup in this segment is Cascading AI, which helps banks make loans to small businesses or SMBs. Based in Connecticut, Bankwell is one bank piloting Cascading AI’s offerings. SMB loans are typically time-consuming and difficult to process — for the banks and the small business owners. Cascading AI’s GenAI-based program gives business owners a portal that asks them qualifying questions and gives onboarding instructions. A human loan officer joins the process after the basics are completed. The cost to the bank, and the experience for the SMB owner, are both improved.

Ask Cloud Wars AI Agent about this analysis

Customer Service

Banks can train chatbots to provide rapid customer service and answer any questions. In the banking world, it’s still common for customers to call their bank or walk into a branch to address a problem. Digital-only neobanks have partially solved this problem by offering a better digital user experience, but they still need customer service reps.

GenAI can help customers manage their accounts — to check their credit score, arrange automatic payments, access a statement, and more. AI can also be used to easily digitize documents.

Financial Advice & Planning

Banks traditionally help their customers with financial planning and investment advice. Right now, however, access to a human financial advisor is usually restricted to high-net-worth clients. GenAI can help banks offer personalized, structured financial advice to all customers. A GenAI program can pull data from across sources and present reports generated as needed to communicate with the customer.

Final Thoughts

Without a doubt, banks also face great challenges when working with AI. Financial data plugged into AI and GenAI systems has to remain secure and private. Training data must be maintained at the highest quality to avoid guiding customers to poor financial decisions. Systems also can’t inherit bias — such as underwriting decisions that reflect disparities based on zip code or race — from the training data. These are large problems that the banking industry has to deal with while developing AI functionality. But from my perspective as a startup founder, every problem is an opportunity in disguise.

Like any mature industry, banking will take time to adapt to AI, in particular GenAI. However, the use cases are so compelling that we already see startups and banks alike pursuing innovative projects.